The world of banking has changed dramatically in the last decade. What once required long queues at a physical branch can now be handled in the palm of your hand. Among the growing number of mobile-first solutions, the (Coyyn Com Banking App) is a name that has caught attention. It positions itself as a convenient, secure, and user-friendly way to manage money without being tied down to traditional banking limitations.

In this article, we’ll explore everything you need to know about the Coyyn Com Banking App. From its key features and usability to its strengths, challenges, and potential role in the future of financial technology, you’ll find a complete guide. Whether you’re considering downloading it for personal use or simply curious about how it compares to mainstream banking apps, this breakdown will give you a solid overview.

What Is the Coyyn Com Banking App?

The Coyyn Com Banking App is designed as a digital-first platform that aims to give users easy access to everyday banking functions. Instead of visiting a branch, customers can use the app to send money, pay bills, track expenses, and access account information instantly.

Its mission appears to be centered on accessibility and simplicity. While traditional banks often weigh customers down with multiple forms, paperwork, and branch visits, this app leans into speed and self-service. With mobile banking adoption growing, especially among younger generations, apps like this represent the shift from traditional financial institutions to flexible, customer-first digital solutions.

Why Mobile Banking Apps Are Changing the Industry

Mobile banking is no longer an optional add-on; it’s now the primary way many people interact with their money. Consumers value the ability to manage finances anytime and anywhere.

Key Drivers of Mobile Banking Growth

- Convenience: No need to visit a branch or ATM for simple tasks.

- Real-time updates: Transactions and balances refresh instantly.

- Security improvements: Encryption, biometric login, and fraud alerts give users peace of mind.

- Lower costs: Apps often come with fewer hidden fees than traditional institutions.

The Coyyn Com Banking App falls into this growing trend, carving out its identity as a tool designed for speed, simplicity, and mobile-first experiences.

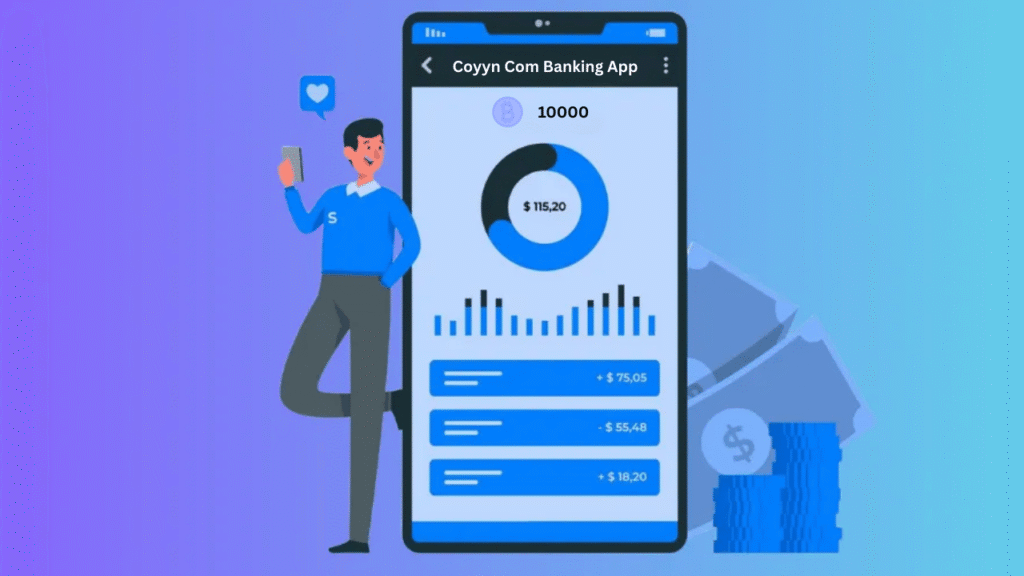

User Experience and Design

When evaluating any banking app, design and usability are at the top of the list.

Intuitive Interface

A strong point of the Coyyn Com Banking App is its user-friendly design. It’s built for people who may not be tech experts, ensuring that even first-time users can navigate menus without confusion.

Ease of Setup

Signing up appears streamlined. Most digital banks now allow account creation with just a few pieces of identification and a smartphone camera. This reduces onboarding friction, a critical factor for adoption.

Everyday Usability

Once logged in, users have immediate access to their core needs: balance checks, money transfers, payment history, and alerts. The simplicity ensures that users spend less time searching for features and more time managing finances effectively.

Key Features of the Coyyn Com Banking App

The app’s appeal lies in the features it offers. While details can evolve as the platform develops, here are the standout functions typically associated with mobile banking solutions like this one.

Real-Time Money Transfers

Send and receive funds instantly, whether to another user or external bank accounts.

Bill Payment Integration

Pay utility bills, subscriptions, or recurring payments directly through the app.

Expense Tracking and Notifications

Get alerts for transactions and monitor spending categories to stay on budget.

Biometric Login

Security is enhanced with fingerprint or face ID, eliminating reliance solely on passwords.

Multi-Device Access

Log in securely from different devices while maintaining account protection.

Security and Privacy in the Coyyn Com Banking App

No banking service can succeed without strong security. Users expect financial apps to provide maximum safety.

Encryption and Authentication

The Coyyn Com Banking App employs industry-standard encryption methods to keep data secure. Biometric login and multi-factor authentication provide another layer of defense against unauthorized access.

Fraud Protection

Suspicious activity alerts and quick account freeze options are often part of modern apps, allowing users to stay in control if anything unusual occurs.

Data Privacy

Privacy matters. The app claims to follow strict guidelines to ensure user information isn’t misused or sold.

How Does the Coyyn Com Banking App Compare to Traditional Banks?

Traditional banks offer stability and in-person service, while mobile-first apps focus on flexibility.

Advantages Over Banks

- Faster account opening

- Lower fees for basic services

- Accessibility from anywhere

- Real-time transaction processing

Potential Drawbacks

- Limited face-to-face customer support

- May not yet offer advanced products like mortgages or business loans

- Dependence on internet connectivity

For many users, the convenience outweighs the drawbacks, especially for personal everyday banking needs.

Who Is the Coyyn Com Banking App For?

This app appears targeted toward digitally savvy users who value speed and independence.

Ideal Users

- Students looking for low-cost accounts

- Freelancers who need fast transfers

- Young professionals managing daily expenses

- Travelers who prefer global, app-based access to funds

Who Might Hesitate

- Older customers used to in-branch service

- Businesses needing complex financial products

- People without stable internet access

Benefits of Using the Coyyn Com Banking App

The advantages of adopting this app revolve around convenience and control.

- 24/7 Account Access – No waiting for banking hours.

- Cost Savings – Fewer fees compared to traditional accounts.

- Instant Transactions – Faster payments mean smoother financial management.

- User-Centric Features – Budgeting, alerts, and personalization keep customers engaged.

Possible Challenges and Limitations

While promising, the Coyyn Com Banking App may face challenges.

- Competition: Dozens of fintech apps compete for the same audience.

- Trust: Some users are skeptical of new or lesser-known platforms.

- Regulation: Compliance with local and international banking laws can be complex.

The key will be how the app addresses these barriers to build long-term trust.

The Future of Apps Like Coyyn Com Banking App

The financial landscape is evolving quickly. Apps like this aren’t just alternatives; they may soon become the norm.

- Integration with AI-driven insights for smarter money management.

- Cross-border payments to make travel and international work easier.

- Partnerships with fintech companies to expand service offerings like insurance or investments.

The Coyyn Com Banking App has the potential to be part of this shift, especially if it continues innovating.

Step-by-Step Guide: How to Get Started

For those interested, here’s how onboarding generally works with similar banking apps.

- Download the App – Available on iOS or Android.

- Sign Up – Provide identification details.

- Verify Your Account – Through email, SMS, or document upload.

- Link Bank Accounts or Cards – For transfers and payments.

- Start Using Core Features – Send money, pay bills, and manage expenses.

The process is often designed to be completed in under 15 minutes.

Why the Coyyn Com Banking App Could Appeal to Gen Z and Millennials

Younger generations are driving fintech adoption. They prioritize convenience, digital-first solutions, and tools that help with financial literacy.

Points of Appeal

- No paperwork-heavy processes

- Easy to set up and use daily

- Mobile budgeting and instant notifications

- Flexibility for digital lifestyles

Final Thoughts

The Coyyn Com Banking App represents what many consumers want from the future of banking: speed, simplicity, and security. While it faces the usual hurdles of trust and competition, it has the foundations to become a strong player in the mobile banking space.

Whether you’re exploring options for your first digital bank account or looking to switch from a traditional provider, this app shows the potential of banking designed around the user.

FAQs

1. What is the Coyyn Com Banking App?

It is a digital-first banking app designed to let users manage accounts, transfers, and payments directly from their smartphones.

2. Is the Coyyn Com Banking App safe to use?

Yes. It employs encryption, biometric login, and security alerts to keep accounts protected.

3. Who can benefit most from the Coyyn Com Banking App?

Students, freelancers, and young professionals who need fast, mobile-friendly banking will find it especially useful.

4. Does the Coyyn Com Banking App replace traditional banks?

Not entirely. While it covers daily financial needs, some services like mortgages or in-branch support may still require a traditional bank.

5. How do I get started with the Coyyn Com Banking App?

Simply download it, create an account, verify your identity, and start using features like transfers and bill payments.

Read More: Gradiopexo.com Review: A Complete Guide to Features, Security, and User Experience