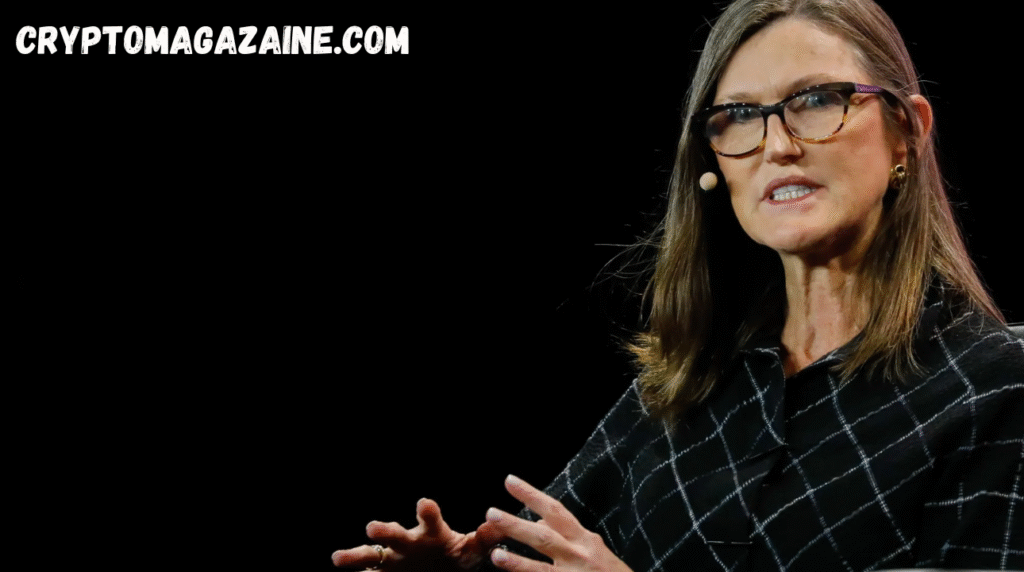

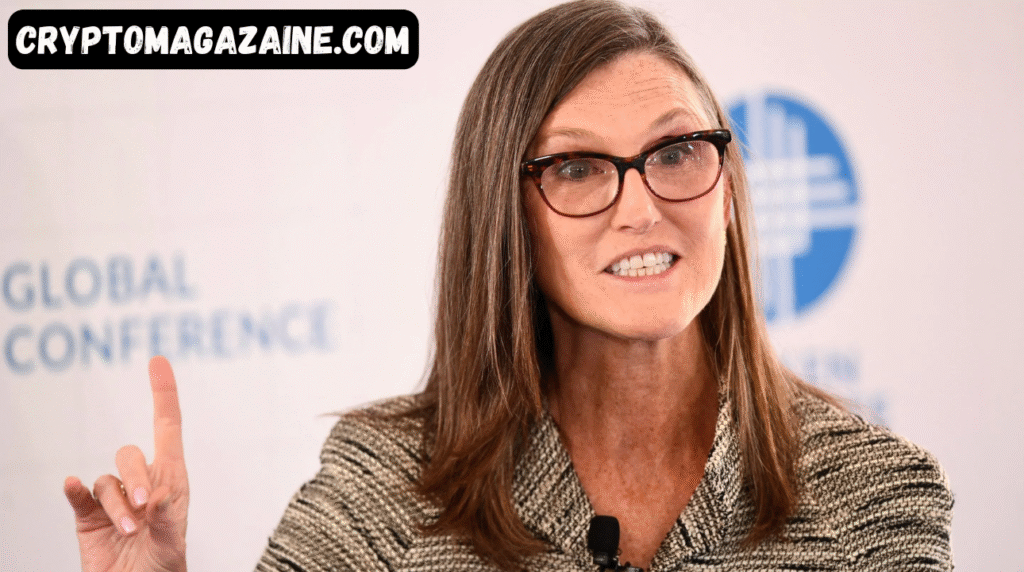

ARK Invest, led by renowned investor Cathie Wood, made a major move in the market by purchasing approximately 353,328 shares of Circle Internet Group (CRCL) for around $30.5 million. These purchases were distributed across three of ARK’s exchange-traded funds: the ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF). This transaction occurred on November 12, 2025, coinciding with a sharp 12% drop in CRCL stock, which closed at $86.30, the lowest closing price since June 5, 2025.

The timing of this purchase reflects ARK Invest’s characteristic strategy: acquiring substantial shares in companies when the market may be temporarily undervaluing them. The drop in Circle’s stock followed the release of its third-quarter (Q3) financial results, which were robust but raised concerns over certain risk factors that weighed on investor sentiment. Despite strong growth, the market reacted negatively, illustrating how short-term macroeconomic concerns can impact stock prices even amid strong earnings.

Circle’s Q3 2025 Financial Performance

Circle Internet Group reported strong financial metrics for Q3 2025, indicating significant year-over-year growth. Highlights include:

- Revenue growth of approximately 66% year-over-year, reaching nearly $740 million.

- Net income of around $214 million, representing a 202% increase from the same quarter in the previous year.

- Earnings per share (EPS) of $0.64, exceeding analysts’ estimates.

- USDC stablecoin circulation reaching roughly $73.7 billion, up 108% compared to the previous year.

Despite these strong numbers, investors focused on forward-looking concerns, particularly the sensitivity of Circle’s revenue to U.S. interest rates. A significant portion of the company’s income comes from interest earned on reserve assets backing USDC, meaning that any reduction in interest rates could reduce profitability. This factor, combined with broader market sentiment, contributed to the steep single-day drop in CRCL stock.

Reasons Behind the Stock Drop

Several factors help explain why Circle’s stock fell despite strong earnings:

- Macro and Interest-Rate Risk: A potential interest-rate cut in the U.S. could reduce returns on the instruments Circle holds to back USDC, making future revenue less predictable.

- Forward Guidance and Costs: Circle’s outlook included increased investments in infrastructure and regulatory compliance, which could temporarily reduce profitability.

- Valuation Expectations: The stock had experienced significant gains earlier in the year, meaning much of the expected growth may have already been priced in.

- Profit Taking and Market Sentiment: After strong performance, some investors likely sold shares to lock in gains, leading to additional downward pressure on the stock.

ARK Invest’s Strategy and Rationale

ARK Invest’s decision to purchase Circle shares at this time reflects a long-term, contrarian investment approach. Key points behind the strategy include:

- Buying the dip: ARK views the 12% drop as a market overreaction, presenting a favorable entry point.

- Confidence in stablecoin infrastructure: Circle is a major player in the stablecoin ecosystem, and ARK is betting on the long-term growth of digital-asset infrastructure and payments solutions.

- Institutional signaling: By acquiring a large position amid market weakness, ARK sends a strong message of confidence to other investors about the future of Circle and stablecoins.

- Valuation opportunity: With the stock temporarily depressed, the risk/reward profile may have improved, making the investment more attractive.

Risks Considerations and Market Implications

While the ARK purchase signals confidence, several risks and factors must be considered when evaluating Circle as an investment:

Interest-Rate Sensitivity

Circle earns a substantial portion of revenue from interest on reserves backing USDC. A decrease in U.S. interest rates could reduce yields, compressing earnings. This interest-rate exposure makes Circle’s business highly sensitive to monetary policy changes.

Regulatory Risks

Stablecoins are increasingly under regulatory scrutiny. Although Circle is relatively well-positioned as a regulated issuer, potential changes in U.S. or international laws could impact operations, increase compliance costs, or limit growth opportunities.

Revenue Concentration and Diversification

Circle’s heavy reliance on reserve income as a revenue source highlights potential vulnerability. Diversification into other income streams, such as subscription services, transaction fees, or enterprise solutions, will be critical for long-term stability and growth.

Market Valuation and Execution Risk

Much of Circle’s anticipated growth may already be reflected in its stock price. Sustaining momentum requires successful execution of strategic initiatives, including expanding infrastructure, building partnerships, and maintaining USDC adoption.

Competitive Landscape

Other stablecoin issuers and digital payment platforms compete for market share. Circle’s ability to maintain dominance in USDC issuance and adoption will depend on network effects, trust, and ongoing innovation.

Implications for Investors and the Market

- ARK’s purchase demonstrates institutional confidence in the stablecoin sector, highlighting the growing interest of long-term investors in digital finance.

- The stock’s sharp drop despite strong earnings illustrates how short-term macroeconomic factors and market sentiment can overshadow fundamental performance.

- Circle’s market position as a leading stablecoin issuer makes it a bellwether for trends in digital assets, payments infrastructure, and fintech innovation.

- Observing ARK’s ongoing buying or selling behavior may provide insights into broader institutional sentiment in the sector.

What to Watch Going Forward

Key factors to monitor in the coming months include:

- Trends in interest income and reserve yields and their impact on earnings.

- Growth in non-reserve revenue sources such as enterprise services, subscriptions, or fees.

- Regulatory developments affecting stablecoin issuance and compliance requirements.

- Adoption and circulation growth of USDC, which reflects real-world demand and usage.

- ARK Invest’s portfolio adjustments and investment patterns as a signal of confidence in Circle’s prospects.

Summary

ARK Invest’s acquisition of $30.5 million in Circle shares amid a 12% drop represents a significant vote of confidence in the stablecoin market and Circle’s long-term potential. While Circle reported strong financial performance with significant revenue and net income growth, the market reacted to interest-rate risks, costs, and forward guidance, causing a steep one-day decline.

The move underscores the contrarian and long-term investment philosophy of ARK Invest and highlights the growing attention of institutional investors in the stablecoin ecosystem. Investors and market observers will be closely watching Circle’s execution, regulatory environment, and USDC adoption to gauge the company’s trajectory and resilience in an evolving fintech landscape.