Oracle NetSuite Financial Management features represent one of the most advanced cloud-based financial systems designed to empower organizations with real-time financial visibility, automation, and control. This comprehensive suite of tools enables businesses to manage all aspects of their accounting, reporting, budgeting, compliance, and financial planning from one centralized platform. Built on a unified cloud architecture, Oracle NetSuite Financial Management eliminates the need for multiple disparate systems, reducing errors, improving accuracy, and enhancing collaboration among finance teams. Its automation capabilities streamline complex financial processes such as consolidations, intercompany transactions, and currency conversions, allowing companies to close their books faster and make informed decisions with up-to-date insights. Businesses benefit from enhanced transparency and a consistent financial data flow that promotes efficiency, accountability, and long-term financial growth.

Core Accounting Capabilities in Oracle NetSuite Financial Management Features

At the heart of Oracle NetSuite Financial Management features lies its robust accounting engine, which manages general ledger, accounts payable, accounts receivable, and fixed assets in one integrated system. The general ledger serves as the foundation for financial reporting, supporting custom chart of accounts, automated journal entries, and real-time financial consolidation. The accounts payable module simplifies vendor payments and expense tracking through automated workflows and approval hierarchies, while accounts receivable ensures timely customer invoicing and cash flow management. Fixed asset management allows accurate depreciation tracking and asset lifecycle management, minimizing manual reconciliation efforts. These accounting features provide businesses with a clear financial picture, enabling seamless audits and compliance while maintaining operational efficiency. The automation of accounting transactions also minimizes errors and enhances the accuracy of every financial record, supporting better control and transparency across all departments.

Financial Planning Budgeting and Forecasting in Oracle NetSuite Financial Management Features

Oracle NetSuite Financial Management features include dynamic tools for financial planning, budgeting, and forecasting that help organizations align their financial goals with strategic objectives. These features empower finance leaders to create detailed, data-driven budgets that reflect current business performance and future market expectations. By using built-in modeling tools, companies can easily adjust forecasts in real-time to account for changes in revenue, expenses, or market conditions. This adaptability ensures that management always has a forward-looking perspective, helping them make proactive financial decisions. Oracle NetSuite’s integrated budgeting capabilities also link operational data with financial projections, allowing managers to analyze the direct impact of strategic initiatives. With continuous forecasting and what-if scenario analysis, businesses can identify opportunities and risks before they materialize, ensuring financial stability and sustained profitability.

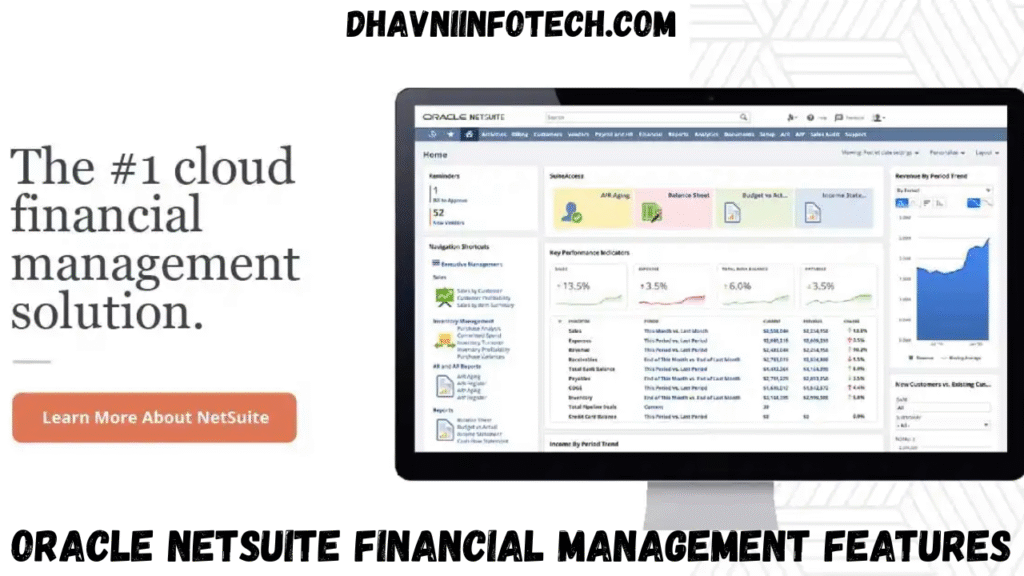

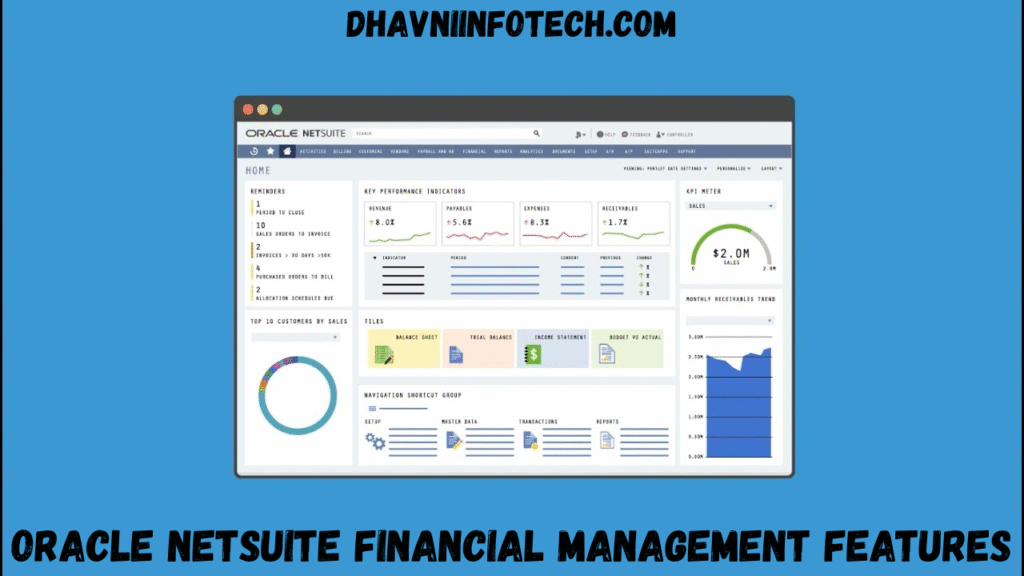

Comprehensive Reporting and Analytics with Oracle NetSuite Financial Management Features

One of the most significant strengths of Oracle NetSuite Financial Management features is its robust reporting and analytics capabilities that transform raw financial data into actionable insights. The system offers customizable dashboards, real-time key performance indicators (KPIs), and automated financial reports that give decision-makers a comprehensive view of business performance. Users can create and modify financial statements such as income statements, balance sheets, and cash flow reports with ease, using drag-and-drop reporting tools. The real-time nature of these reports means executives and finance teams can track performance metrics as they happen, allowing for quicker decisions and better responsiveness to changing conditions. Additionally, advanced analytics tools help organizations drill down into specific accounts, transactions, or departments to uncover trends, inefficiencies, and areas for improvement. This data-driven approach enhances transparency and strengthens overall financial governance.

Revenue Management and Recognition under Oracle NetSuite Financial Management Features

Revenue management is a vital part of Oracle NetSuite Financial Management features, designed to help companies comply with complex accounting standards such as ASC 606 and IFRS 15. The revenue recognition engine automates the process of identifying, allocating, and recognizing revenue based on performance obligations, ensuring complete compliance and accuracy. This feature helps eliminate manual calculations and reduces the risk of misstatements by ensuring that every transaction is properly recorded and recognized over the appropriate period. Businesses can manage different revenue streams, including subscriptions, services, and product sales, from a single system that automatically aligns with contractual terms. By providing a clear view of deferred and recognized revenue, finance teams gain a better understanding of profitability and future cash flow expectations, which is essential for long-term strategic planning and reporting.

Global Business Management through Oracle NetSuite Financial Management Features

Oracle NetSuite Financial Management features are particularly powerful for multinational organizations that operate across different currencies, languages, and tax jurisdictions. Its global consolidation capabilities allow seamless financial management across subsidiaries and regions, ensuring compliance with both local and international accounting standards. Multi-currency support enables automatic currency conversions and real-time exchange rate updates, simplifying cross-border transactions. The system also includes localized tax management tools that adapt to specific country regulations, ensuring accurate tax reporting and compliance. Moreover, global organizations benefit from centralized visibility into performance across all subsidiaries, with consolidated reporting and elimination of intercompany transactions. This unified approach ensures that leadership teams have complete control and insight into the entire financial ecosystem of the organization, fostering better decision-making and operational agility.

Compliance and Governance in Oracle NetSuite Financial Management Features

Compliance and governance are fundamental aspects of Oracle NetSuite Financial Management features, designed to ensure adherence to regulatory standards and corporate policies. The platform supports various compliance frameworks, including GAAP, IFRS, and SOX, making it suitable for public and private entities alike. Automated audit trails record every transaction and adjustment within the system, providing transparency and accountability that auditors can easily trace. Built-in controls, role-based permissions, and segregation of duties prevent unauthorized access and minimize the risk of fraud. Compliance reports can be generated automatically, reducing the workload of finance teams and ensuring accurate documentation for audits or regulatory reviews. This emphasis on governance and compliance strengthens the organization’s credibility and helps maintain investor confidence while mitigating potential risks.

Automation and Integration Benefits in Oracle NetSuite Financial Management Features

A defining strength of Oracle NetSuite Financial Management features is its ability to integrate seamlessly with other business modules and automate repetitive processes. Through its unified cloud infrastructure, the platform connects financial data with inventory, customer relationship management (CRM), human resources, and supply chain management systems. This interconnectedness eliminates data silos, ensuring that all departments operate from a single version of truth. Automation features reduce manual intervention by streamlining processes such as data entry, reconciliation, approvals, and reporting. This not only improves accuracy but also frees up finance professionals to focus on strategic activities like cost optimization and growth analysis. By automating end-to-end workflows, Oracle NetSuite enhances productivity, operational efficiency, and overall financial performance.

Scalability and Customization of Oracle NetSuite Financial Management Features

Oracle NetSuite Financial Management features are built for scalability, making them ideal for businesses at various stages of growth. Whether a company is a startup or a large enterprise, the system can adapt to changing business structures, processes, and requirements. Customization tools allow organizations to configure workflows, dashboards, and reports according to their specific needs, ensuring that the software evolves alongside the company. Its modular design lets businesses add or remove functionalities as they expand into new markets or industries. Moreover, the platform’s continuous updates from Oracle ensure access to the latest technological advancements and compliance standards without disruption. This scalability and flexibility make Oracle NetSuite a future-proof solution that supports long-term growth and digital transformation.

Conclusion

In conclusion, Oracle NetSuite Financial Management features deliver a powerful, all-in-one cloud solution that simplifies accounting, strengthens compliance, enhances reporting, and drives business performance. Its comprehensive set of tools provides finance teams with real-time insights, automation, and global visibility that improve decision-making and operational control. Businesses using Oracle NetSuite benefit from increased efficiency, reduced costs, and the ability to scale effortlessly as they grow. The combination of automation, integration, and real-time reporting ensures that organizations can maintain financial accuracy and agility in an ever-changing market.

FAQs

Q1: What makes Oracle NetSuite Financial Management features unique?

They offer a unified cloud platform combining accounting, reporting, compliance, and automation to provide real-time financial insights.

Q2: Can Oracle NetSuite handle multinational financial operations?

Yes, it supports multi-currency transactions, global consolidation, and localized tax compliance for international businesses.

Q3: How does Oracle NetSuite help with compliance and governance?

It ensures regulatory adherence with automated audit trails, built-in controls, and compliance-ready reporting.

Q4: Is Oracle NetSuite suitable for small and large enterprises alike?

Absolutely, the platform’s scalability and customization features make it adaptable for companies of any size or complexity.

Q5: How does Oracle NetSuite improve financial decision-making?

Through real-time analytics, automated reports, and forecasting tools, Oracle NetSuite empowers leaders with actionable financial intelligence.