Introduction

In recent years, HMRC has turned its attention toward the growing world of digital assets. As cryptocurrency adoption rises, so does the focus on ensuring that crypto investors in the UK are paying the right amount of tax. HMRC letters target undeclared crypto income have become increasingly common, reminding taxpayers that gains from crypto transactions must be properly reported.

These letters often result from HMRC’s expanding access to data from major crypto exchanges, including platforms like Coinbase. As the bitcoin value increases and crypto trading becomes mainstream, HMRC’s tax compliance systems are becoming sharper and more data-driven.

Background: HMRC and Cryptocurrency Tax Compliance

In the UK, HMRC treats cryptocurrency as an asset rather than a currency. This classification means that profits from buying and selling crypto are generally subject to capital gains tax (CGT).

Those who engage in frequent trading or mining activities may also owe income tax instead. It depends on whether HMRC considers their crypto activity as a trade or investment.

Additionally, many people wonder, “Does Coinbase report to HMRC?” The answer is yes — exchanges are required to share customer data when requested. This enables HMRC to track undeclared crypto activity more effectively and ensure compliance.

The HMRC Letters Explained

These official communications from HMRC are part of a broader initiative to encourage voluntary disclosure. Generally, there are three types of HMRC crypto letters:

- Nudge letters – gentle reminders encouraging taxpayers to review and report their crypto gains.

- Compliance check letters – formal requests for detailed transaction records.

- Investigation or penalty warning letters – used when HMRC suspects intentional tax evasion.

Receiving such a letter doesn’t automatically mean wrongdoing. However, it signals that HMRC has data suggesting potential discrepancies in one’s crypto income reporting.

Why HMRC Is Targeting Undeclared Crypto Income

HMRC’s campaign to address undeclared crypto income stems from multiple factors.

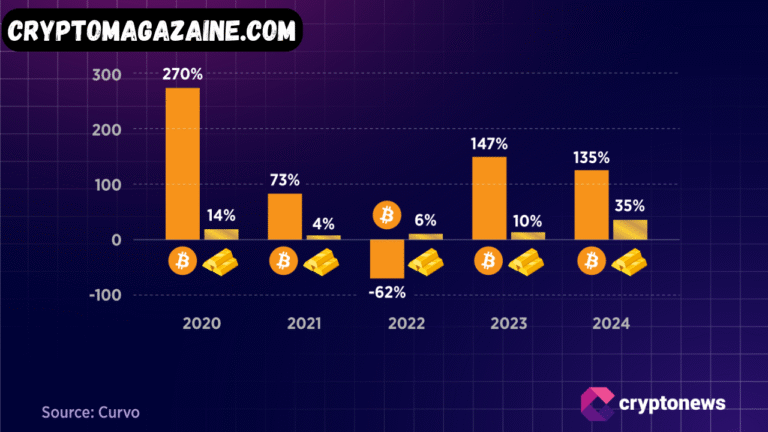

The increase in crypto trading activity, particularly during periods of bitcoin value increase, has drawn attention to unreported profits.

Furthermore, HMRC has enhanced its data-sharing agreements with both UK-based and international crypto platforms. With blockchain analytics tools, the authority can now trace transactions across wallets and exchanges with remarkable precision.

These actions are part of a broader strategy to close the tax gap and ensure fairness among taxpayers.

How to Respond to an HMRC Crypto Letter

When an individual receives an HMRC letter about crypto income, the most important thing is not to ignore it. Instead, they should:

- Review crypto records – Gather transaction histories, exchange logs, and wallet data.

- Assess potential tax liability – Determine if capital gains tax or income tax applies.

- Seek professional help – Consult a tax adviser experienced in UK crypto taxation.

- Disclose undeclared income – Use HMRC’s Digital Disclosure Service (DDS) if needed.

Taking quick, transparent action helps mitigate penalties and demonstrates good faith compliance.

Potential Consequences of Non-Disclosure

Failing to disclose undeclared crypto income can lead to serious consequences. HMRC may impose financial penalties based on the size and intent of the underpayment.

In severe cases, criminal investigations could be initiated for deliberate evasion.

Beyond penalties, ignoring tax obligations can affect a taxpayer’s credibility with HMRC, leading to stricter audits and closer financial scrutiny in the future.

How to Stay Compliant in the Future

To avoid receiving an HMRC crypto letter in the future, investors should develop good record-keeping habits. This includes maintaining logs of every crypto transaction and using crypto tax calculation tools to track gains and losses.

When submitting a Self Assessment tax return, any crypto-related gains should be declared accurately. Understanding cryptocurrency tax UK regulations and the capital gains tax UK crypto structure helps ensure ongoing compliance.

Finally, staying up to date with HMRC announcements and tax thresholds will prevent surprises during future filing seasons.

Professional Help and Resources

For those unsure how to calculate their crypto taxes or respond to HMRC letters, hiring a qualified crypto tax specialist is highly recommended.

HMRC also offers resources such as its official Cryptoassets Manual, which provides guidance on how digital assets are treated under UK tax law.

Professional assistance not only helps clarify complex tax rules but also ensures accurate reporting and peace of mind.

Conclusion

HMRC decision to target undeclared crypto income highlights the growing importance of tax compliance in the UK’s digital economy. As cryptocurrencies continue to rise in popularity, HMRC’s scrutiny is expected to increase.

The best way to stay ahead is through transparency — accurately reporting crypto earnings and keeping detailed records. By doing so, investors can avoid unnecessary stress, penalties, and ensure their crypto journey remains fully compliant.

For more Updates: Crypto Magazaine