After a turbulent October marked by sharp volatility and a surprisingly deep mid-month correction, Bitcoin enters November on shaky but intriguing footing. The world’s largest cryptocurrency is currently consolidating around the $110,000 zone, a level that has become a battleground for bulls and bears alike. ETF flows, global macroeconomic data, liquidity conditions, investor sentiment, and shifting institutional behavior are all shaping what many analysts describe as a “critical junction” for Bitcoin.

While Bitcoin (BTC) closed October with a +53% year-to-date performance — impressive by traditional market standards — the mood across crypto remains divided. Some traders argue that Bitcoin still needs to sweep deeper liquidity pockets before regaining upside momentum, perhaps even retesting the $90,000–$95,000 zone. Others fear something more ominous: that the most recent breakdown signals the beginning of the end for the entire bull cycle.

With two months left in 2025, the stakes could not be higher. The upcoming macro shifts — including potential rate adjustments, renewed ETF inflows, and dollar liquidity trends — will strongly influence whether Bitcoin continues higher or slips into a more prolonged correction phase.

In this extended November report, we examine current market structure, institutional flows, analyst perspectives, and the increasingly relevant question: If Bitcoin falls below $100,000, does it still deserve its “digital gold” status?

A Market at Crossroads Is This a Reset or a Cycle Peak?

Since the sharp selloff on Oct. 10, Bitcoin has been locked inside a defined range, trading roughly between $105,000 and $116,000. The behavior resembles a classic ping-pong pattern — each time price approaches support, it bounces swiftly, yet each test of resistance is rejected just as fast.

- Support holding: ~$105,000

- Resistance ceiling: ~$116,000

- No decisive breakout: Bulls lack conviction, bears lack dominance

- Volatility compressing: Often a precursor to major expansion

In contrast to Ethereum and most altcoins — many of which overreacted to the correction — Bitcoin has displayed relative resilience. This divergence illustrates that capital is still prioritizing BTC over riskier assets.

‘This Feels Like a Reset, Not a Cycle Peak’ — Market Perspective

Cais Manai, Co-Founder and Head of Product at TEN Protocol, described the market structure not as the end of a bull cycle but rather as a mid-cycle reset. According to Manai, this kind of corrective phase is typical during major uptrends, especially when funding rates, leverage, and market sentiment become overheated.

He explains:

- A deeper pullback could serve as healthy rebalancing, not a trend reversal.

- A test near $90,000 remains possible but not necessarily bearish.

- If macro conditions improve, Bitcoin could rebound sharply from any deeper dip.

This view is shared by several long-term analysts who argue that Bitcoin has not shown the hallmark signs of a true cycle peak — such as prolonged parabolic blow-off top behavior, excessive retail frenzy, or a multi-week vertical appreciation phase.

Buyer Exhaustion or Accumulation Zone? The Liquidity Question

Maria Carola, CEO of StealthEx, emphasizes that liquidity conditions remain the key determinant of whether Bitcoin can reclaim higher levels in November and December. She notes that the setup for a year-end rally does exist — strong ETF participation, increasing global interest, and historical seasonality — but stresses that nothing is guaranteed.

Carola highlights several prerequisites for Bitcoin to break out and possibly form a new all-time high:

- Improved liquidity conditions across global markets

- Renewed capital inflows into Bitcoin ETFs

- Stabilizing macroeconomic indicators, especially interest rates

- A shift in investor sentiment away from caution and toward accumulation

- Sustained institutional demand

If these factors align, Bitcoin may attempt another run toward $125,000–$135,000. If they do not, the market may face prolonged sideways action — or an even deeper correction.

Institutional Flows The Cautious Return of Smart Money

One of the defining features of this cycle has been Bitcoin ETF activity. The first week of October saw massive inflows:

- Oct. 6: Over $1 billion in net inflows

- Oct. 10: Another surge, right before the crash

At the time, the outlook appeared overwhelmingly bullish. Bitcoin tested new highs, and altcoins began rallying in tandem. But in hindsight, that setup now resembles a classic bull trap.

When the correction hit on October 10:

- Bitcoin ETFs recorded $4.5 billion in net outflows, a dramatic and sudden reversal.

- This forced selling amplified the downside and wiped out highly leveraged long positions.

- Many institutions stepped back temporarily, monitoring macro signals rather than aggressively adding exposure.

But institutions are returning — slowly and carefully.

Recent ETF data shows modest, steady inflows rebuilding during late October and early November. This suggests that large players remain fundamentally bullish, but are waiting for:

- More attractive entry zones

- Clearer Federal Reserve guidance

- Reduced market leverage

- A drop in volatility

Their re-entry appears strategic rather than speculative — a sign of accumulation rather than panic buying.

Is Bitcoin Losing Its ‘Digital Gold’ Status if $100k Breaks?

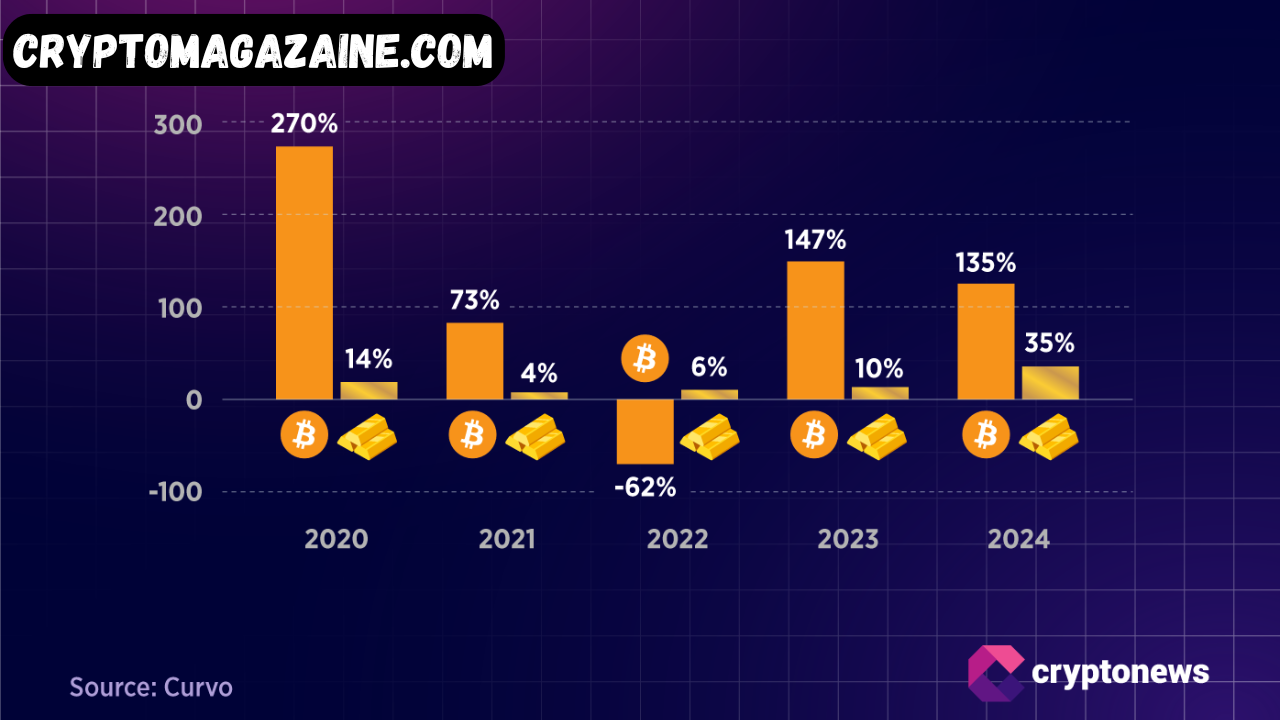

Bitcoin’s yearly returns tell a compelling story:

- Past 5 years: Mostly above +50% annual performance

- 2022: The lone exception, marked by a brutal -62% decline

- 2024: Gold rose ~35%, its best year in half a decade

Bitcoin’s resilience, despite massive volatility, is what earned it the nickname “digital gold.” Yet some analysts argue that if BTC breaks below $100,000, that title may be questioned.

However, the comparison may be misleading.

Gold’s value lies in stability.

Bitcoin’s lies in asymmetric upside.

A correction to $90,000 would not invalidate its long-term narrative. Instead, it would represent:

- A normal retracement within a macro uptrend

- A liquidity sweep before continuation

- A healthy reset after overheated conditions

Historically, every Bitcoin cycle has included:

- 30–40% pullbacks

- Mid-cycle corrections

- Sentiment-driven overreactions

Yet BTC has always emerged stronger.

Unless Bitcoin collapses into a multi-year downtrend — which current data does not support — its digital gold status remains intact.

November Outlook What Lies Ahead for the Market’s Leading Asset?

Bitcoin sits at an inflection point:

Bullish Scenarios (if liquidity improves)

- Break above $116,000 → run toward $125k–$135k

- Strong ETF inflows return

- Macro conditions stabilize or turn favorable

- Traders rotate capital from altcoins back into BTC

- Institutional accumulation accelerates

Bearish Scenarios (if support fails)

- Break below $105,000 → test $98k

- Loss of $98k → liquidity vacuum toward $90,000

- Prolonged consolidation before a new attempt higher

- Short-term fear, but long-term structure remains healthy

Neutral/Range-Bound Scenarios

- BTC stays between $105k and $116k

- VIX drops, global markets stabilize

- Traders wait for December/January catalysts

- Slow buildup before the next major move

At the moment, Bitcoin appears to be preparing for expansion — but the direction is still uncertain. Neither bulls nor bears are firmly in control. The range continues, compression increases, and historically, such environments precede major volatility.

Conclusion Not a Cycle Top — A Crucial Reset Phase

Based on market structure, historical patterns, analyst commentary, and institutional flows, the current environment resembles a mid-cycle reset far more than a cycle peak.

- Corrections are normal

- Liquidity is rotating

- ETF flows are stabilizing

- Macro landscape is shifting

- Institutional demand is re-emerging

Bitcoin has shown resilience throughout 2025, delivering strong year-to-date performance even amid volatility. Whether the price retests $90,000 or rebounds directly from $105,000, the long-term narrative remains intact.

The next two months will determine whether Bitcoin finishes the year with renewed momentum — or whether the market must endure a deeper reset before the next major upward leg.

Read More: Four Crypto Millionaires Trapped Outside a $3 Billion Blockchain Fortune