Indirect relief may not fuel the same crypto surge as direct stimulus checks did in 2020–21.

A Weekend of Crypto Euphoria

The cryptocurrency market roared back to life over the weekend following President Donald Trump’s announcement of a “tariff dividend” for low-income Americans a statement that many investors initially interpreted as a new round of direct stimulus checks. The news, posted on Trump’s Truth Social account, immediately triggered a wave of optimism across social media platforms like X (formerly Twitter), Reddit, and Telegram.

Bitcoin (BTC) surged past $106,000, while popular altcoins like XRP, DOGE, UNI, and ZEC followed suit, recording double-digit gains in a matter of hours. The CoinDesk 20 Index jumped more than 5% to 3,469 points, as traders and retail investors celebrated what they believed would be another liquidity injection into the U.S. economy and by extension, the crypto markets.

For many, the announcement evoked strong memories of the pandemic-era stimulus payments, which coincided with a spectacular bull run that saw Bitcoin rally from under $10,000 in early 2020 to an all-time high near $69,000 in November 2021. That historical connection between fiscal stimulus and crypto market euphoria was top of mind for traders hungry for another leg up in this year’s rally.

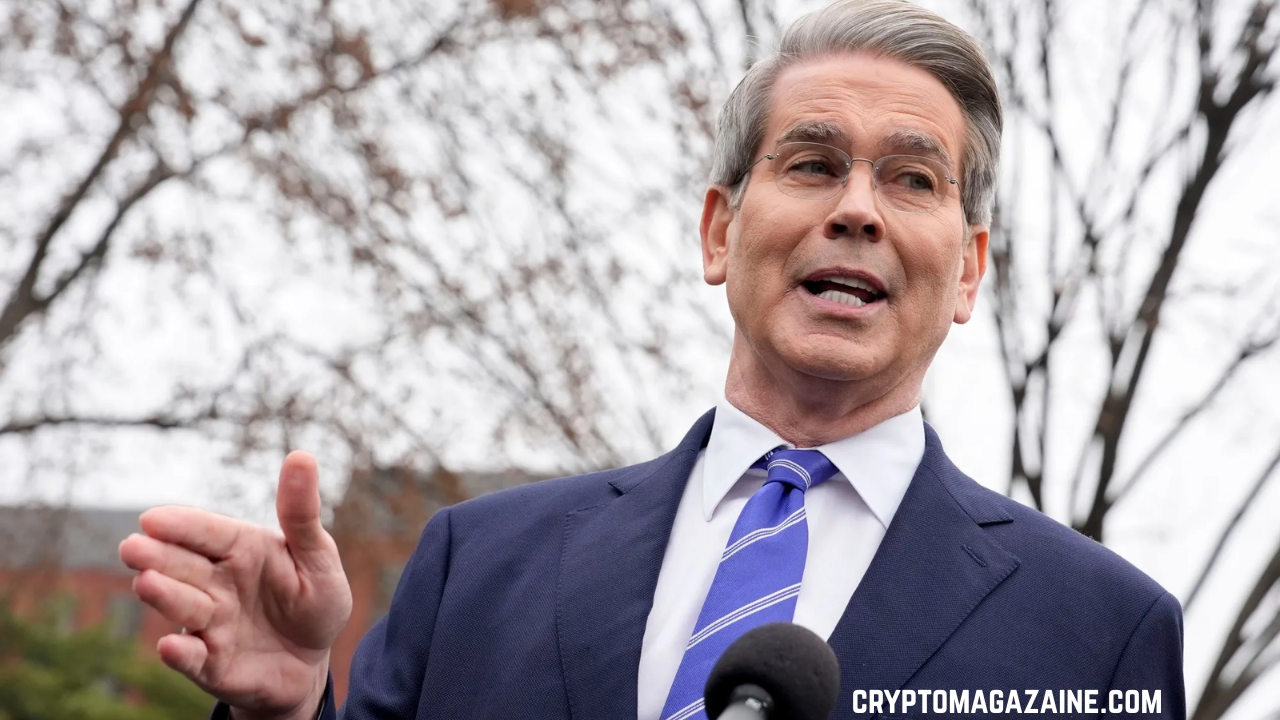

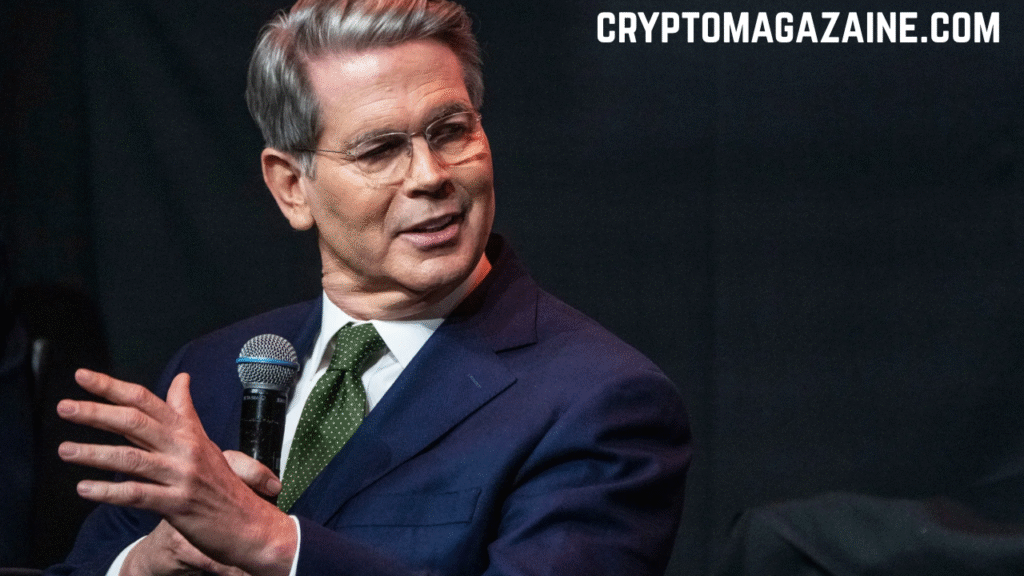

Bessent Clarifies The Dividend Might Be Indirect

However, Treasury Secretary Scott Bessent moved quickly to clarify the details of the so-called “tariff dividend,” tempering some of the weekend’s enthusiasm. Speaking on ABC’s This Week, Bessent explained that the President’s plan might not involve direct checks to households but could instead be delivered through targeted tax cuts and deductions.

“The $2,000 dividend could come in lots of forms, in lots of ways,” Bessent said. “It could be just the tax decreases that we are seeing on the president’s agenda no tax on tips, no tax on overtime, no tax on Social Security – deductibility on auto loans.”

This clarification quickly poured cold water on the idea of another round of “free money.” While tax cuts can increase disposable income over time, they generally do not provide the immediate liquidity injection that stimulus checks deliver. The market, which thrives on direct and rapid flows of capital, began to reassess its early optimism.

Why Indirect Relief Hits Differently

Economists note that direct payments like the COVID-era checks tend to have a multiplier effect on spending and risk-taking behavior. When individuals receive tangible, lump-sum cash inflows, they are more likely to spend or invest immediately, often in high-volatility assets like stocks or cryptocurrencies.

Tax cuts, by contrast, spread the benefits over a longer period and typically favor those with higher or more stable incomes. While they do boost long-term disposable income, their short-term impact on consumer spending or speculative investment tends to be more muted.

“It’s a classic case of a bird in the hand is worth two in the bush,” said one macro strategist. “Markets react strongly to direct stimulus because it’s certain, visible, and immediate. Tax cuts are less tangible and unfold gradually, which doesn’t generate the same burst of momentum in risk assets.”

Crypto Instant Gratification Bias

The crypto ecosystem is particularly sensitive to liquidity shocks. During previous stimulus periods, blockchain data showed that a measurable portion of U.S. stimulus checks found their way into exchanges and DeFi platforms, driving rapid surges in prices and trading volume.

In 2021, Bitcoin and Ethereum reached record highs within months of the third round of stimulus payments. Retail-driven tokens such as DOGE and SHIB saw astronomical gains, fueled by social media hype and the flood of new money entering the system.

That dynamic explains why crypto traders initially greeted Trump’s “tariff dividend” post with such enthusiasm. For many, it represented a potential replay of one of crypto’s most explosive bull market catalysts. However, Bessent’s clarification that the “dividend” could manifest as reduced taxes rather than direct checks shifted the narrative from instant liquidity to gradual fiscal easing.

Markets Pause Momentum Cools

After rallying as high as $106,500 early Monday during Asian trading hours, Bitcoin’s upward momentum began to cool by mid-morning. Prices retreated slightly, stabilizing around the $106,000 level as traders digested the implications of Bessent’s comments.

Altcoins also lost some steam, though many retained strong 24-hour gains. XRP, UNI, WLFI, and ZEC were still up between 8% and 25%, reflecting the broader market’s optimism albeit tempered by uncertainty about the true scope of the government’s fiscal plans.

Different Economic Context, Different Reaction

Analysts caution against drawing overly direct parallels to the 2021 cycle. The macroeconomic backdrop today looks markedly different.

During the 2020–2021 period, inflation was below the Federal Reserve’s 2% target, and interest rates were near zero, creating an environment of abundant liquidity and aggressive risk-taking. In contrast, the current landscape features interest rates around 4% following recent cuts and inflation still roughly a full percentage point above target.

This means that even if fiscal measures like tax cuts do boost consumer confidence, the effects may be offset by tighter monetary conditions and lingering price pressures. In short, the Fed is far less likely to tolerate another speculative bubble fueled by easy money.

The Psychological Effect of Free Money

Market psychology also plays a crucial role. Stimulus checks during the pandemic carried a strong psychological impact they were direct, visible, and universal. Many recipients, particularly younger or lower-income individuals, viewed them as “found money” and used them for riskier investments like crypto or meme stocks.

Tax cuts, on the other hand, tend to be less visible and less emotionally stimulating. A gradual increase in take-home pay doesn’t produce the same rush of optimism or sense of newfound wealth that a lump-sum deposit does. As a result, the crypto market’s behavioral trigger the feeling of sudden windfall liquidity is largely absent.

Will the Tariff Dividend Still Matter for Crypto?

Still, not everyone is dismissive. Some analysts argue that any form of fiscal relief, whether direct or indirect, could support the broader economic narrative of increased disposable income and consumer activity.

Even if slower to materialize, tax cuts could contribute to sustained demand for risk assets over time, especially if they accompany other growth-friendly measures like deregulation and investment incentives.

“It may not be a sugar rush like the COVID checks,” said one digital asset strategist. “But steady fiscal support can provide a healthier, more durable base for long-term market expansion including crypto.”

Bottom Line Optim@ism With a Dose of Reality

President Trump’s talk of a “tariff dividend” reignited the imagination of crypto investors hoping for another stimulus-fueled rally. Yet, as Treasury Secretary Bessent clarified, the details matter — and those details suggest a more gradual form of economic relief, not a flood of direct cash payments.

For now, markets remain buoyant but cautious. Bitcoin continues to trade above $106,000, up roughly 4% in 24 hours, while altcoins hold on to solid gains. But the tone has shifted from unbridled euphoria to measured optimism, as traders await further clarity on the administration’s fiscal agenda.

In the end, the question remains:

Will Americans spend their “tariff dividend” on groceries — or on crypto?

That answer may determine whether the next leg of the Bitcoin bull run has truly begun, or whether it’s just another weekend spike in an increasingly headline-driven market.

Read More: AI vs AI: How New Technologies Are Combating Sophisticated Crypto Scams