Bitcoin Faces Heavy Volatility Amid Market Shakeout

Bitcoin, the world’s largest cryptocurrency, experienced one of its most volatile trading sessions in months, plunging to just above the $100,000 mark before rebounding slightly to $101,000. The sharp move came as a wave of forced liquidations swept through the crypto market, erasing over $2 billion in leveraged positions in less than a day.

According to data from CoinGlass, long traders those betting on higher prices absorbed nearly $1.6 billion of those losses, signaling a massive deleveraging across the sector. The event marked one of the largest liquidation-driven selloffs since September, highlighting how fragile market positioning has become after several weeks of choppy, uncertain trading.

What Are Liquidations and Why Do They Matter?

In crypto futures markets, liquidations occur when traders who use borrowed funds (leverage) can no longer meet the margin requirements set by exchanges. When prices move sharply against a trader’s position, the platform automatically closes their trade to prevent further losses.

This creates a domino effect forced selling accelerates price declines, which triggers even more liquidations. Similarly, when short positions are liquidated during price increases, it can cause a rapid surge upward.

Analysts often use liquidation heatmaps visual charts showing where leveraged positions cluster to identify potential zones of forced buying or selling. These areas frequently become short-term support or resistance levels, giving traders insight into where price volatility may occur next.

Billions in Liquidations Across Major Exchanges

The impact of the latest liquidation event was broad and severe across top exchanges.

Breakdown of data shows:

- Bybit: $628 million in liquidations

- Hyperliquid: $533 million

- Binance: $421 million

- HTX (formerly Huobi): Recorded the single largest liquidation an $11 million BTC-USDT long position forcibly closed

The magnitude of these figures underlines just how aggressively leveraged the market had become. Even modest downward movements in Bitcoin’s price were enough to wipe out billions in open interest across global trading platforms.

Ripple Effect ETH SOL XRP and Others Fall Hard

The selloff was not confined to Bitcoin. The broader crypto market endured heavy losses as liquidity dried up and confidence weakened.

- Ether (ETH) dropped around 10% to $3,275

- Solana (SOL) and BNB each fell between 7–8%

- XRP, Dogecoin (DOGE), and Cardano (ADA) declined by 5–6%

As a result, the total crypto market capitalization tumbled back toward $3.5 trillion, marking its lowest level in over a month. The drop erased nearly $400 billion in notional value in just 48 hours a reminder of how quickly crypto wealth can evaporate in a leveraged downturn.

Macroeconomic Pressure Adds Fuel to the Fire

Market analysts say this liquidation storm didn’t occur in isolation. A renewed risk-off sentiment in global markets added pressure across risk assets, including crypto.

Recent speculation that the U.S. Federal Reserve may delay further rate cuts sparked concerns among traders. Simultaneously, renewed worries over tariffs, credit market stress, and high equity valuations have made investors more cautious.

Gerry O’Shea, Head of Global Market Insights at Hashdex, told CoinDesk:

“Bitcoin traded around $100,000 today as risk-off sentiment took hold of financial markets, impacting digital assets, stocks, and commodities alike. The broader market narrative has turned defensive.”

This shift in tone mirrors traditional finance patterns, where tightening liquidity conditions and economic uncertainty push investors toward safer assets like bonds or gold and away from speculative plays like crypto.

The Psychological Importance of the $100,000 Mark

The $100K level holds deep psychological and technical importance for Bitcoin traders. Crossing six figures earlier this year symbolized Bitcoin’s growing maturity and mainstream legitimacy. Now, revisiting that threshold from above is testing the resolve of both short-term traders and long-term holders.

Analysts view $100,000 as a crucial support zone. If Bitcoin can defend this level, it may establish a base for a new accumulation phase. However, a clean break below could trigger another round of long liquidations, potentially sending the price toward $95,000 or lower.

As O’Shea noted:

“While $100,000 is a key psychological threshold, the current volatility does not undermine Bitcoin’s long-term investment case. These corrections are natural in evolving markets.”

Long-Term Fundamentals Still Strong

Despite the immediate chaos, most institutional analysts remain optimistic about Bitcoin’s long-term fundamentals. Key factors supporting that outlook include:

- Institutional Adoption: Spot Bitcoin ETFs continue to see strong inflows from pension funds and asset managers.

- Scarcity and Halving Dynamics: The upcoming halving in 2028 is expected to reduce supply growth, historically a bullish driver.

- Macro Trends: Persistent inflation and geopolitical uncertainty are encouraging investors to diversify into digital assets.

Mei Ling, a strategist at BlockTower Capital, observed:

“Volatility is an unavoidable part of leverage-driven markets. But structurally, Bitcoin’s narrative as a digital reserve asset remains intact. These flush-outs are more like growing pains than breakdowns.”

Deleveraging The Market Natural Cleanse

Large-scale liquidations, though painful, can serve a healthy market function.

When leverage builds up too much, it inflates asset prices beyond sustainable levels. A deleveraging event purges weak positions and restores balance between buyers and sellers.

Historically, such corrections have paved the way for future rallies. Data from 2021, 2023, and early 2025 show that after each major liquidation spike, Bitcoin consolidated briefly before resuming its upward trend.

CryptoQuant analyst Rafael Dominguez put it succinctly:

“We’re witnessing another much-needed flush. Leverage had become dangerously high, and this reset was inevitable. Once excess risk is cleared, markets typically stabilize.”

Traditional Markets Mirror the Crypto Pullback

The crypto correction came alongside weakness in global equity and commodity markets.

- The S&P 500 dropped 1.2%

- Gold climbed slightly as investors sought safety

- The U.S. Dollar Index (DXY) strengthened, reflecting a flight to liquidity

This alignment underscores how Bitcoin has evolved into a macro-sensitive asset. Unlike earlier years when it moved independently, BTC now trades in tandem with risk assets, responding to global liquidity conditions, policy expectations, and investor sentiment.

Selling by Long-Term Holders A Normal Rotation

On-chain data suggests that part of the selling pressure came from long-term Bitcoin holders wallets that have held BTC for over 12 months.

While that might sound bearish, it’s typically seen as part of a healthy market cycle. Veteran investors often take profits after significant rallies, allowing new entrants to accumulate coins at lower levels.

Data from Glassnode shows that long-term holders have distributed around 120,000 BTC since mid-October, indicating a controlled reallocation rather than panic-driven dumping.

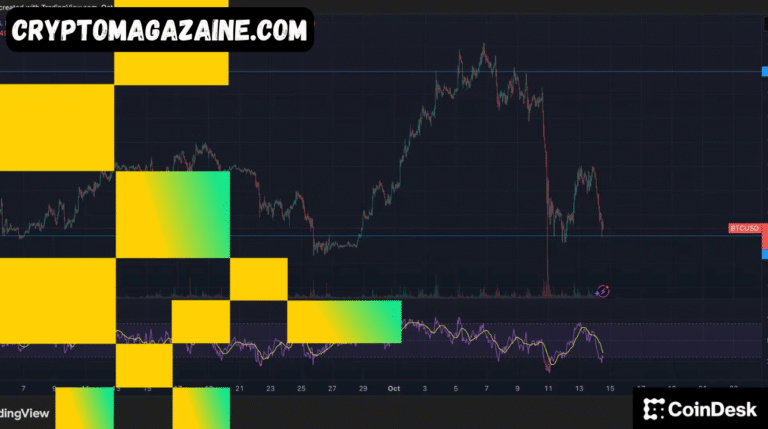

Traders Focus on Liquidation Zones for the Next Move

Short-term traders are now watching liquidation clusters to gauge where price volatility may flare next.

According to CoinGlass heatmap data, large concentrations of open interest remain around $98,500 (on the downside) and $103,000 (on the upside).

If Bitcoin rebounds and liquidates over-leveraged shorts above $103K, momentum could quickly push prices toward $108K–$110K. But if $100K fails to hold, cascading long liquidations could drive a sharp dip toward the mid-$90,000 range.

This makes the coming sessions critical in determining whether the current bounce becomes a sustained recovery — or just a temporary reprieve.

Investor Sentiment Fear Opportunity or Both?

Social sentiment data from LunarCrush and Santiment shows heightened volatility in trader emotions. Fear and uncertainty dominate short-term chatter, but optimism remains strong among long-term investors.

On platforms like X (formerly Twitter) and Reddit, discussions emphasize the phrase “shaking out leverage before the next leg up,” reflecting the community’s view that corrections like this are precursors to renewed growth.

Institutional players appear to agree. Spot Bitcoin ETFs reported modest inflows during the dip, suggesting that large investors are buying the fear — a classic behavior in maturing markets.

Lessons from Previous Liquidation Events

This is far from the first time Bitcoin has endured a leveraged wipeout.

- In May 2021, over $8 billion in positions were liquidated during the China mining crackdown.

- In June 2023, BTC fell 12% in a day amid similar futures liquidations, only to recover within weeks.

- Each time, the pattern was the same: leverage built up, a correction occurred, weak hands exited, and Bitcoin eventually resumed its uptrend.

This historical consistency reinforces the argument that such events, while unsettling, are part of Bitcoin’s natural rhythm — a market constantly resetting to prepare for the next phase of adoption and growth.

Looking Ahead Can Bitcoin Reclaim Momentum?

In the days ahead, market focus will center on whether Bitcoin can maintain support above $100,000 and rebuild confidence among traders.

If macroeconomic conditions stabilize and leverage remains subdued, analysts believe BTC could recover toward $110,000–$115,000 by late November.

However, persistent uncertainty especially around Fed policy and global credit tightening — may keep volatility elevated in the short term.

Conclusion Volatility Is the Price of Progress

Bitcoin’s dramatic tumble near $100K serves as both a cautionary tale and a reminder of the market’s resilience.

Over $2 billion in leveraged bets were erased in hours, but the long-term thesis — that Bitcoin is evolving into a global, decentralized financial reserve — remains intact.

In the end, volatility is the price of innovation.

Each wave of liquidations clears excess risk and strengthens the market’s foundation. For investors who understand Bitcoin’s cyclical nature, these moments represent not fear — but opportunity.

As Hashdex’s Gerry O’Shea aptly summarized:

“Bitcoin’s volatility is not a flaw; it’s a feature of price discovery in a new global asset class. Every correction strengthens its long-term trajectory.”

Read More: Balancer DeFi Protocol Suffers Major Exploit