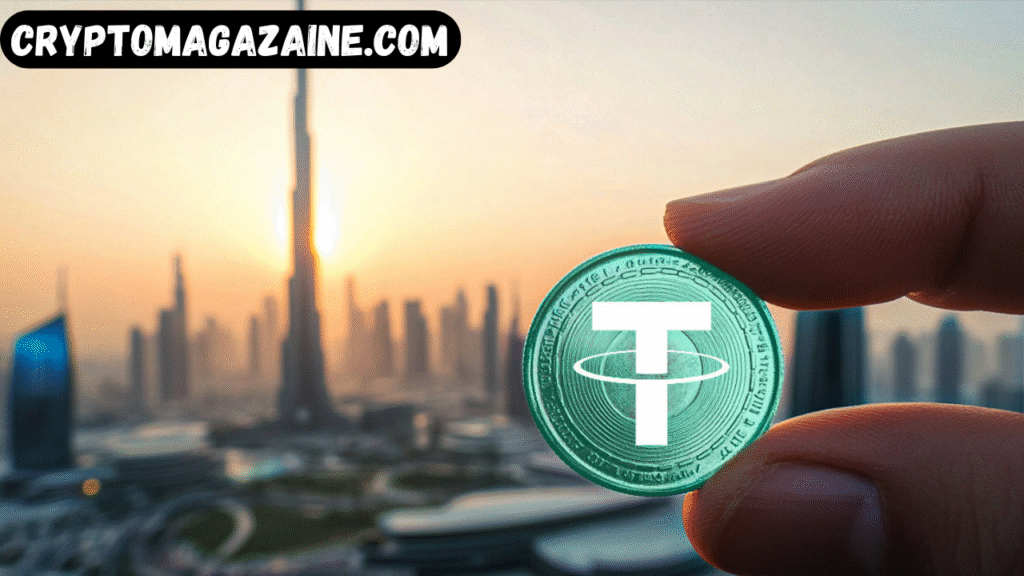

Tether’s flagship stablecoin, USDT, has received a significant regulatory milestone after the Abu Dhabi Global Market (ADGM) formally recognized it as an approved fiat-referenced token across an extensive list of major blockchain networks. The development strengthens USDT’s global legitimacy and aligns with the UAE’s rapidly expanding strategy to become a leading hub for regulated digital-assets, stablecoins, and blockchain-based financial infrastructure.

The decision places Tether among the most widely supported and institutionally endorsed stablecoins within the Middle East, while also demonstrating Abu Dhabi’s unique regulatory approach — combining strict oversight with an openly pro-innovation stance.

ADGM Formally Approves Multichain USDT Across the Region

According to Tether’s statement, ADGM now authorizes licensed financial institutions inside the free-zone to conduct regulated activities involving USDT across a broad range of blockchain networks. Newly recognized chains include:

- Aptos

- Celo

- Cosmos

- Kaia

- Near

- Polkadot

- Tezos

- TON

- TRON

These join earlier approvals for USDT on Ethereum, Solana, and Avalanche, creating one of the most expansive multichain regulatory recognitions anywhere in the world.

This also gives ADGM-licensed firms the green light to support USDT for custody, settlement, trading, tokenization, on-chain payments, and decentralized-application (dApp) infrastructure across nearly every major chain where USDT circulates.

Executives and analysts view this as a key step in making the UAE a preferred jurisdiction for stablecoin issuance, liquidity operations, institutional DeFi, and cross-border blockchain payments.

Stablecoins Now Seen as Core to Global Digital Finance

Tether CEO Paolo Ardoino emphasized that this regulatory approval reflects a maturing perspective in global financial systems, where stablecoins are evolving from crypto-native tools to indispensable financial instruments.

“Introducing USDT within ADGM’s regulated digital asset framework reinforces the role of stablecoins as essential components of today’s financial landscape,” Ardoino stated.

He added that the multichain recognition strengthens Abu Dhabi’s credibility as a compliant, future-ready digital-asset center, capable of bridging traditional finance with modern blockchain-based economic activity.

Abu Dhabi Global Market’s Expanding Crypto Ambitions

ADGM—an international financial center with its own legal, regulatory, and judicial system—has been aggressively positioning itself as a top-tier digital-asset hub, competing with jurisdictions like Singapore, Hong Kong, and the EU’s MiCA framework.

The Financial Services Regulatory Authority (FSRA) oversees licensing within ADGM and has built a reputation for clear guidelines around virtual assets, custody, tokenized securities, and now, stablecoins.

The newly issued USDT recognition aligns with Abu Dhabi’s broader plan:

build a regulated, institution-grade crypto market that attracts global exchanges, token issuers, fintech startups, and sovereign-level financial partners.

Binance Gains Full ADGM Authorization on the Same Day

In a development symbolically aligned with Tether’s announcement, Binance confirmed that it has secured full authorization to operate its primary global platform, Binance.com, under the supervision of ADGM authorities.

This milestone follows years of regulatory scrutiny across multiple regions and marks one of Binance’s most significant compliance achievements.

Under the ADGM structure, Binance will operate through three separate legal entities:

- An Exchange – enabling regulated spot and possibly derivatives trading

- A Clearing House – ensuring settlement and clearing functions

- A Broker-Dealer Entity – bridging institutional clients with regulated market infrastructure

Binance Co-CEO Richard Teng, a former ADGM regulator himself, called the approval a reflection of ADGM’s “gold-standard” expectations for crypto oversight.

Pending operational onboarding, Binance is expected to begin regulated operations on January 5, 2026, reinforcing Abu Dhabi’s strategy of maintaining high regulatory standards while actively embracing innovation.

Tether Rebuts Arthur Hayes’s Insolvency Warnings Amid Market Volatility

The recognition arrives during renewed debate over Tether’s reserve backing, sparked by Arthur Hayes, BitMEX founder, who claimed that a 30% fall in Tether’s Bitcoin and gold holdings could potentially wipe out its equity.

However, counteranalysis from CoinShares Head of Research James Butterfill sharply rejected the alarm:

- Tether holds $181+ billion in reserves

- Against $174.45 billion in liabilities

- Leaving a surplus of roughly $6.78 billion

Butterfill stated that reserves remain substantial, especially given Tether’s treasury holdings and interest income flows.

Tether CEO Ardoino has also pushed back strongly, revealing updated numbers:

- Total Tether Group assets: ~$215 billion

- Excess equity: ~$7 billion

- Retained earnings: ~$23 billion

- Bitcoin + gold share of reserves: 12.6%

- Short-term US Treasuries: 70%+

Ardoino accused critics of misunderstanding attestation data, noting that Tether now earns around $500 million per month in interest from its treasury holdings — providing significant financial stability.

These debates occur against a backdrop of wider global financial turbulence, partly tied to:

- volatility in Japanese government bonds,

- negative sentiment from weak US labor data, and

- broader macroeconomic uncertainty that often spills into crypto markets.

A Milestone Moment for Stablecoins and the UAE’s Digital Strategy

The ADGM’s decision marks one of the most comprehensive formal recognitions for USDT globally and represents a broader international shift toward regulated stablecoin frameworks.

For the UAE, it serves as another cornerstone in its effort to become:

- a global crypto-regulatory leader,

- a home for top-tier exchanges,

- a center for tokenized finance,

- and a gateway for cross-border blockchain settlements.

For Tether, the move reinforces its stance as the largest and most widely used stablecoin — not only in crypto markets but increasingly in global payment, remittance, and institutional digital-asset ecosystems.

KEYWORDS as requested

Tether, USDT, stablecoin, Abu Dhabi Global Market, ADGM, Paolo Ardoino, Binance authorization, Binance ADGM, fiat-referenced token, UAE crypto regulation, multichain USDT, Aptos, Celo, Cosmos, Polkadot, TON, TRON, Near, Tezos, Kaia, Ethereum, Solana, Avalanche, FSRA, digital-asset hub, stablecoin regulation, Arthur Hayes, insolvency risks, Tether reserves, US Treasuries, crypto markets, UAE digital strategy, regulated crypto exchange, blockchain finance, settlement infrastructure.