In a year already marked by accelerating institutional adoption, shifting regulatory winds, and renewed optimism across digital asset markets, the United States may be on the brink of approving a new category of crypto investment vehicles. Canary Funds’ XRP Trust—soon to be listed on Nasdaq—has positioned itself to become the first pure spot XRP exchange-traded fund (ETF) ever to debut in the country, potentially redefining how mainstream investors gain exposure to the broader altcoin ecosystem.

If certified as expected, the product will open the door to the first U.S.-regulated, fully backed, spot-based exposure to XRP—an asset long known for its use-case-oriented design in cross-border payments and settlement infrastructure. The anticipated launch represents more than a routine ETF approval; it points to a new era where digital assets beyond Bitcoin and Ethereum gain institutional legitimacy.

A Final Regulatory Step Toward Market Debut

Canary Funds’ filing of Form 8-A with the U.S. Securities and Exchange Commission—a crucial final step for new securities products—signaled the ETF’s readiness for open market trading. According to Bloomberg ETF analyst Eric Balchunas, this filing effectively serves as the ETF’s final procedural clearance before the exchange itself activates the listing.

Pending Nasdaq’s certification, expected by 5:30 p.m. ET on Wednesday, the ETF could officially go live for trading as soon as Thursday morning.

This rapid timeline reflects a streamlined approval process under the Securities Act of 1933, which governs commodities-style spot products. Unlike futures-based ETFs or blended-exposure funds, the Canary XRP Trust will offer direct, one-to-one spot backing. Every share corresponds directly to XRP held in custody with a regulated trust structure—no derivatives, no swaps, and no hybrid tracking mechanisms.

In an ecosystem where regulatory clarity remains fragmented, this structure allows the product to deliver a clean, transparent, and institutionally friendly way to access XRP’s price performance.

Why This Matters Institutional Demand Beyond Bitcoin and Ethereum

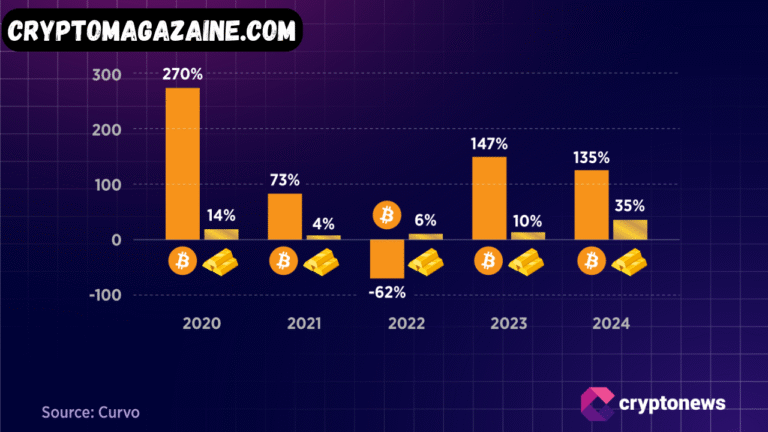

The debut of U.S.-listed spot Bitcoin ETFs in January 2024 triggered one of the largest capital influxes in ETF history. Within weeks, registered investment advisers (RIAs), pension funds, corporate treasuries, and hedge funds rebalanced portfolios to include Bitcoin exposure. This success paved the way for spot Ether ETFs, which are now live and operating with broad investor interest.

But altcoins—assets beyond the “big two”—have remained largely absent from regulated investment products.

The potential approval of the Canary XRP Trust marks a turning point.

A spot XRP ETF:

- Expands the liquidity base of XRP.

- Offers regulatory clarity for institutions that previously avoided direct crypto exposure.

- Opens doors for RIAs and wealth managers, many of whom can only purchase SEC-regulated products.

- Encourages diversification into utility-driven networks like XRP for payment and settlement applications.

If successful, the fund may serve as a test case for broader altcoin ETFs, including pending applications for Solana and other networks with specialized use cases.

This shift reflects a critical evolution in the U.S. ETF landscape—a movement from speculative narratives to infrastructure-oriented digital assets.

How Canary’s Product Differs From Existing XRP Exposure

While REX-Osprey recently launched the $XRPR ETF, that product operates under the Investment Company Act of 1940, a framework designed for traditional securities portfolios rather than direct crypto holdings. As a result, XRPR offers only partial exposure to XRP, with allocations mixed among other assets and higher tracking costs.

By contrast, the Canary XRP Trust offers:

- Full, 100% spot backing

- Direct XRP custody

- Lower structural complexity

- Cleaner price tracking

- More favorable tax treatment

This distinction matters for price discovery. When institutional capital flows into spot-backed products, markets tend to behave more efficiently, liquidity deepens, and volatility—while still present—aligns more closely with underlying demand rather than derivative market distortions.

For XRP, a network widely used in cross-border settlement and liquidity provisioning, cleaner price discovery may help further integrate the asset into global payment rails.

Why XRP? The Ecosystem’s Evolution Matters

XRP has spent years navigating a regulatory landscape clouded by the SEC’s lawsuit against Ripple, which began in 2020 and culminated in a landmark 2023 ruling classifying XRP sales on secondary markets as non-securities. This legal clarity, combined with Ripple’s ongoing expansion of enterprise settlement systems, has re-established XRP as one of the most utilized networks in real-world financial infrastructure.

With a global footprint across remittance corridors, liquidity hubs, and institutional banking partners, XRP represents a class of digital assets built for payments—not speculative smart contract experimentation.

An ETF centered on such an asset introduces a new category of investment product: one focused not only on store-of-value or programmable finance, but on tokenized settlement systems for global payments.

Market Reaction and XRP Price Behavior

As news of the potential ETF listing circulated, XRP traded near $2.48 in Asian market hours on Wednesday, down roughly 5% amid broader crypto market volatility.

Short-term price movement remains reactive to global risk sentiment. But ETF analysts suggest that long-term ETF-driven inflows tend to stabilize and strengthen an asset’s price floor. If Bitcoin’s ETF performance is any indicator, early inflows often precede months of sustained interest from:

- Retirement accounts

- Wealth managers

- Institutional index funds

- Multi-asset ETF model portfolios

Given XRP’s established market cap and global liquidity footprint, the introduction of a U.S. spot ETF could reposition the asset within the institutional investment universe.

A Milestone for the Entire Crypto Market

Approving the Canary XRP Trust would signal that U.S. regulators—and major exchanges like Nasdaq—are finally moving beyond Bitcoin and Ethereum toward a more diversified crypto investment ecosystem.

This represents:

- A broadening of acceptable digital assets for U.S. institutional markets

- Increased competition among ETF issuers

- Potential greenlights for additional spot products such as Solana, Avalanche, or other high-utility networks

- A redefinition of crypto market maturity, moving past monolithic dominance by BTC and ETH

The approval also comes nearly two years after spot Bitcoin ETFs reshaped global investment flows and helped drive institutional adoption to record highs.

In that context, an XRP spot ETF is not only overdue—it may be the next logical step in building a multi-asset digital economy.

Looking Ahead What This ETF Means for Ripple and U.S. Crypto Regulation

For Ripple, the ETF underscores the legitimacy of XRP as a regulated, institutionally acceptable asset for payment infrastructure and cross-border liquidity solutions.

For the U.S. crypto market, the ETF could represent:

- A shift toward asset-specific regulatory clarity

- Greater alignment with global crypto regulatory frameworks

- Momentum for diversified ETF offerings

- A stronger foundation for institutional trust

If the ETF proves successful, it may set precedent for future spot ETFs built around established, utility-driven blockchains. Beyond that, it could encourage regulators to consider more nuanced approaches to token classification, custody frameworks, and digital asset taxation.

In the long arc of crypto history, Bitcoin opened the institutional door. Ethereum expanded it through programmable finance. Now, XRP may widen this doorway further by demonstrating that real-world utility networks also deserve a place in the regulated investment landscape.

Conclusion A New Era of Crypto ETF Diversity

The imminent launch of Canary Funds’ XRP Trust marks a watershed moment. It symbolizes the U.S. market’s pivot toward broader, more inclusive, and utility-focused crypto investment products. If successful, this ETF could catalyze further institutional diversification beyond the long-dominant Bitcoin–Ethereum axis.

A new chapter in digital asset investing may be about to open—one where a token built for global payments becomes the centerpiece of the next phase of regulated crypto market evolution.

Read More: XRP Price Prediction Can XRP Realistically Reach $5.50 By Year-End 2026?