China, once the world’s most influential hub for Bitcoin trading and mining, has continued to intensify its multi-year effort to eradicate cryptocurrency-related activity within its borders. The latest push comes after a senior official from The People’s Bank of China expressed strong support for expanding restrictions that go far beyond the country’s earlier bans.

According to a government memo cited by Reuters, the official argued that shutting down remaining avenues of crypto-market participation is essential to safeguarding financial stability and preventing capital flight.

Background: China’s Long History of Crypto Restrictions

Early Regulation and the 2017 Nationwide Ban

China’s relationship with cryptocurrency has been turbulent. In 2017, regulators imposed a sweeping ban on cryptocurrency-to-fiat exchanges and prohibited all initial coin offerings (ICOs). The move dramatically reshaped the global crypto landscape, pushing local exchanges offshore and signaling Beijing’s intention to maintain firm control over speculative financial activity.

Why China Grew Wary of Crypto

Authorities in China have long viewed digital assets as sources of systemic financial risk. Concerns include:

- Unregulated capital outflows

- Financial fraud

- Excessive speculation among retail investors

- Difficulty monitoring decentralized transaction networks

These concerns have driven policymakers to take increasingly strict measures as the crypto sector evolved.

Vice Governor Pan Gongsheng Calls for Tougher Measures

A Senior Central Bank Official’s Warning

The latest development centers on comments made by Vice Governor Pan Gongsheng, who is widely known for having once predicted the “death” of Bitcoin. Speaking at a government meeting in early January, Pan argued that China must not only uphold earlier bans but significantly widen them.

Targeting Additional Crypto-Industry Services

According to the internal memo, Pan urged authorities to crack down on a variety of services that enable or support crypto trading. These include:

- Settlement providers

- Market-makers

- Guarantor institutions

- Peer-to-peer lending vehicles used for trading

- Alternative trading platforms

- Cryptocurrency wallet operators

Pan emphasized that even indirect involvement in facilitating crypto transactions should be prohibited.

Local Governments Asked to Monitor and Restrict Mining

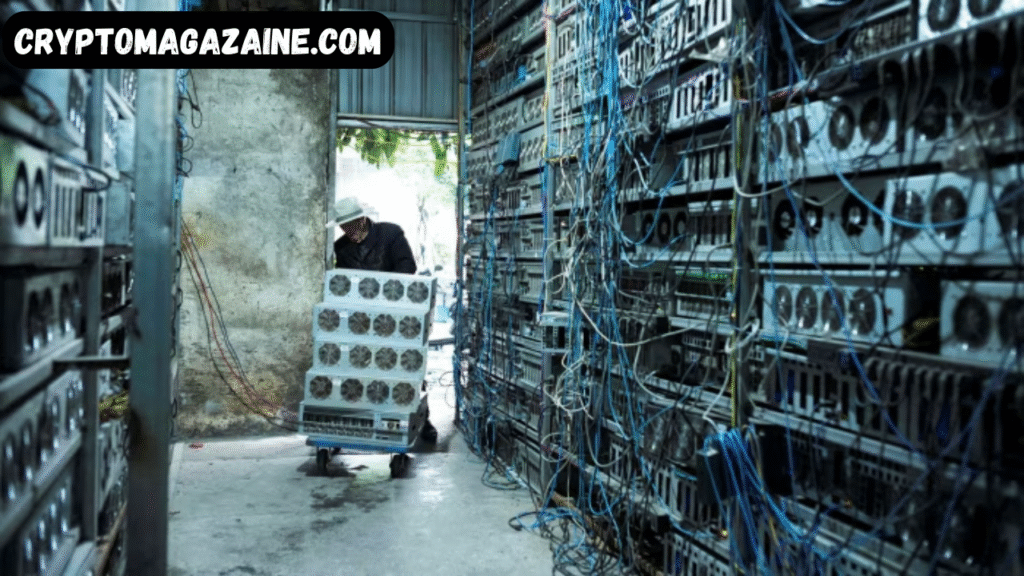

China’s Dominance in Cryptocurrency Mining

China has for years been a global powerhouse in cryptocurrency mining, thanks to its access to cheap electricity and large-scale mining farms clustered in certain provinces.

Proposed Tools to Reduce Mining Activity

Pan suggested an “orderly exit” strategy for mining operations, encouraging local authorities to:

- Monitor and limit energy consumption

- Adjust electricity pricing structures

- Use tax policy to deter mining

- Apply land-use and environmental regulations to pressure operators

These measures are intended to systematically shrink China’s mining footprint without causing sudden disruptions.

Major Crypto Exchanges Shift Overseas

A Forced Transformation After the Crackdown

Businesses such as OKEx and Huobi Pro were once giants in China’s booming digital-asset landscape. After the 2017 ban, both companies redirected their strategies to survive the regulatory storm.

New Focus on OTC and Overseas Crypto-to-Crypto Markets

To continue serving customers while complying with domestic restrictions, these exchanges have shifted toward:

- Over-the-counter (OTC) trading, which relies on private dealers instead of centralized crypto-fiat exchanges

- Crypto-to-crypto trading venues hosted outside China

These models allow traders to continue participating in global markets, although often in more complicated and fragmented ways.

Pan’s Warning About Overseas Money Movement

Concerns Over Cross-Border Capital Flow

Pan highlighted particular concern for websites and mobile apps that help Chinese citizens circumvent capital controls. Platforms that enable people to convert yuan into digital assets and move funds abroad are seen as threats to government oversight of financial activity.

Call to Sanction Facilitating Platforms

Pan recommended that authorities take decisive action against:

- Websites enabling OTC crypto trades

- Apps that help users bypass domestic banking restrictions

- Services promoting overseas crypto-account registration

He stressed that even technologically neutral tools can become “channels for illegal financial activity” when abused in the crypto ecosystem.

Broader Implications for China and the Global Crypto Market

Impact on Domestic Innovation

While China remains a leader in blockchain research—especially in areas approved by the state—the continued crackdown may dampen private-sector innovation related to open, decentralized networks.

Influence on Global Bitcoin Markets

Historically, actions taken by Chinese regulators have caused major fluctuations in global crypto prices. A further crackdown, particularly in mining, could influence:

- Global hash rate distribution

- Bitcoin network decentralization

- The cost structure of mining worldwide

Shift of Crypto Power to Other Regions

As China tightens restrictions, other countries—particularly in North America, Central Asia, and parts of Europe—are becoming new hubs for mining and exchange business development.

Conclusion: China Signals Its Determination to Control Cryptocurrency Activity

China’s expanded crackdown represents a continuation of its long-standing effort to curb speculative financial behavior and maintain control over capital flows. With senior officials like Pan Gongsheng calling for aggressive action, the government appears intent on closing the remaining loopholes that allow cryptocurrency activity to persist.

Whether these measures will fully eliminate crypto trading within China—or simply push it further underground or overseas—remains to be seen. What is clear is that the Chinese government’s stance is becoming increasingly assertive, reshaping both the domestic and global crypto landscape.

Read More: PayPal Massive $1 Million Bitcoin Giveaway Shocks the Crypto Worl