Monad has become one of the most widely discussed crypto launches of 2025. Its initial coin offering (ICO), hosted exclusively on Coinbase, has elevated the project to a level of visibility that few new chains receive. Influencers are promoting it non-stop, communities are speculating, and many traders are preparing for what they expect to be one of the strongest launches of the year.

But behind the excitement lies a growing concern: could Monad be the next Layer-2 (L2) project to rocket during launch week, only to collapse into the same long-term downward spiral that has swallowed so many other L2 tokens?

Multiple analysts believe this is not only possible — but likely.

A Flooded Layer-2 Market: “Why Would I Need Another Layer 2?”

Matas Čepulis, Founder and CEO of LuvKaizen, told Cryptonews that Monad reminds him of several heavily funded L1 and L2 chains that entered the market with big promises but failed to deliver sustainable value. Čepulis compared Monad to projects like Sei (SEI), Sui (SUI), and Avalanche (AVAX). All three raised enormous amounts of capital, generated impressive early hype, and built loyal communities — only to break down as growth slowed and token performance lagged behind expectations.

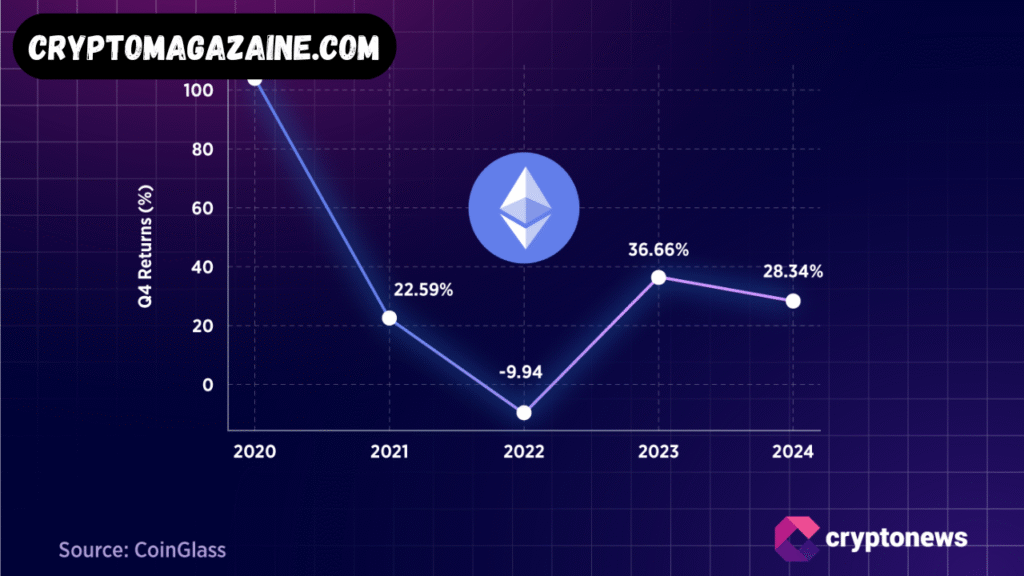

Token price behavior across the L2 landscape does not inspire confidence either. According to data from CoinPaprika, many Layer-2 tokens have fallen 90% or more from their all-time highs. In the crypto community, this kind of drop is typically referred to as a “death,” meaning the token’s early hype evaporated and long-term recovery now seems unlikely.

There are a few exceptions. Mantle (MNT) is down around 67% from its ATH, but it continues to benefit from strong support from Bybit, which regularly introduces new passive-income features that help maintain interest. Zora (ZORA) has also held up surprisingly well, remaining 64% below its ATH — but Zora’s price is still largely driven by speculation and social hype rather than actual network usage.

But these tokens are young. Their long-term sustainability remains untested.

For most L2s, the biggest issue is simple oversaturation. As Ethereum and the broader ecosystem expanded, L2s were genuinely needed to reduce gas fees and increase throughput. But the aggressive rise of Web3, NFTs, and DeFi created a landscape where new chains appeared faster than users could evaluate them. Many were clones, offering no unique technological innovation.

Today, the market looks similar to the AI sector: promising, rapidly expanding, and filled with countless competitors — most of which will fail.

Čepulis argues that Monad may face this same problem. The infrastructure is becoming crowded, user attention is limited, and technological differentiation is becoming harder to communicate.

So Why Is Monad So Popular?

Monad is not just any new project — it has captured attention across crypto communities for several reasons.

First, it has strong institutional and community backing. Coinbase’s exclusive hosting of the ICO is a massive advantage, especially since U.S. users can participate. This is extremely rare due to regulatory constraints and gives Monad access to liquidity and visibility that most new chains simply cannot match.

Second, Monad’s ecosystem — particularly its NFTs, trading cards, and early marketplace activity — has brought in a broader audience than typical infrastructure projects. Even though the NFT sector has been in decline for years, Monad’s digital collectibles have seen surprising engagement leading up to launch.

Third, speculative traders are entering aggressively. After months of market corrections, participants are hungry for new opportunities. The Monad token fits perfectly into short-term trading strategies, especially among those who missed the biggest rallies of the year.

At the moment, however, interest appears far more focused on the token than on the technology itself. This is common during pre-launch hype cycles, but it also increases volatility and creates higher risks of immediate sell-offs.

Will the Monad Launch Change Anything?

The big question now is what will happen on launch day and in the weeks that follow. There are two realistic scenarios.

1. A Quick Pump Followed by a Heavy Sell-Off

This has been extremely common in 2025. Traders enter early, push the price higher, and exit quickly to lock in profits. Čepulis notes that this behavior has become dominant because the old “buy and hold” strategy has failed many traders this year.

One clear example is the recent Uniswap (UNI) rally, where retail participants reacted after the price had already climbed, missing most of the upside while early insiders took profits.

2. The Classic L2 Decline Pattern

Many L2 projects experience a slow fade after launch. The hype pushes prices and user activity up, but once the excitement fades, token demand drops. Without unique technology or real user traction, prices grind down gradually until the project becomes another forgotten name in the crowded L2 roster.

Some experts fear Monad may follow this path if it cannot differentiate quickly enough.

The Big Nuance: Tokenomics Raise Serious Red Flags

Despite the successful ICO, one of the largest concerns around Monad is its token distribution.

A very large portion of the MON supply is allocated to the team and early investors. This raises two major issues:

- These insiders control most of the potential upside.

- If they choose to sell early — even gradually — the market could face intense downward pressure.

Čepulis adds that many community members who spent months farming Monad may receive only a small allocation compared to what they expected. Meanwhile, a large number of accounts on X (formerly Twitter) are aggressively promoting Monad, raising further questions about how the supply will circulate once trading begins.

Another unknown factor: users who bought into the ICO may have a vastly different cost basis than those who farmed the network. The difference in incentives could lead to unpredictable early price movements.

Post-Launch Expectations: What Comes Next for Monad?

Given all the variables — extreme hype, questionable tokenomics, influencer-driven marketing, and an oversaturated Layer-2 landscape — the Monad launch stands at a critical juncture.

If demand stays strong and the team executes flawlessly, Monad could buck the L2 trend and become one of the few projects to build long-term value.

But far more experts believe that Monad’s token is being driven by speculation, not fundamentals. This increases the probability of a launch that follows the standard crypto playbook:

A massive surge in interest

A sharp early pump

A heavy correction

And then a long period where the project must prove it is not just another short-lived hype cycle.

For now, the only certainty is that the market is watching closely. The excitement is real — but so are the risks.

If Monad cannot demonstrate true innovation and sustained utility, early investors may celebrate a brief victory while long-term holders face the same painful decline seen across most L2 tokens released over the past few years.

Read More: How Prediction Markets Like Polymarket Kalshi and Others Are Winning While Crypto Falls