The crypto market has been shaken once again — not because Bitcoin crashed, not because a new regulation appeared, but because a billionaire insider has issued one of the boldest statements of the year. Cameron Winklevoss, co-founder of Gemini and one of the earliest Bitcoin investors, has warned his 1.6 million followers that “this is the last time you’ll ever be able to buy Bitcoin below $90,000.”

His words have amplified across the market just as Bitcoin slipped from its $124,000 peak and entered an area that analysts have been watching closely for months. Traders, long-term investors, and institutions are now asking: What does he know? And even more importantly: Is this really the final discounted opportunity before Bitcoin rockets into the six-figure range permanently?

This article breaks down the full market situation, the exact technical structure, why billionaires are suddenly so vocal, and what could happen next — whether you’re a short-term trader or a long-term holder.

The Current Bitcoin Market Setup — Calm Before the Next Storm

Bitcoin trades around $91,687, with a market capitalization of $1.82 trillion and a circulating supply now approaching 20 million BTC. As the supply nears the fixed maximum of 21 million, the pressure from scarcity continues to intensify. Every year there are fewer new Bitcoins entering the system — and more buyers competing for them.

After smashing a new all-time high around $124,000, Bitcoin entered a sharp correction that shocked new investors but did not surprise veteran cycle analysts. Every Bitcoin bull run in history has seen deep retracements before continuing higher, and this one appears to be no different.

However, what makes this pullback special is the price zone Bitcoin has now revisited.

Bitcoin Has Entered the Final Deep Value Zone A Rare Historical Window

The current decline has pushed BTC into the $83,800 – $90,000 demand zone, the same area that triggered a massive rally in April. It also aligns with the 0.618 Fibonacci retracement — a level historically associated with bottoms during long-term uptrends.

Nearly every major Bitcoin cycle has shown a similar structure:

| Stage | Price Movement | Market Psychology |

|---|---|---|

| Early Bull | Slow steady rise | Accumulation |

| Mid Bull | Parabolic surge | Euphoria |

| Correction (Now) | Sharp multi-week pullback | Fear and disbelief |

| Late Bull | Explosive rally | Mania + all-time highs |

The correction stage is where smart money and institutions build positions — and where panic sellers usually exit.

This is the real reason billionaire investors are calling attention to the moment.

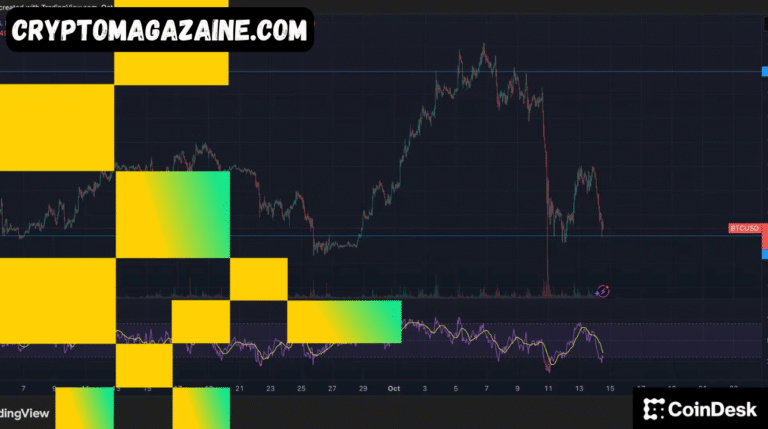

Technical Outlook — Reversal Signals to Watch

Bitcoin has broken below its long-term trendline from early 2025 — a meaningful structural change. Daily candles show a controlled series of lower closes, and an RSI near 30 reflects oversold conditions not seen since last year’s accumulation phases.

Key levels traders are watching:

Support zones

- $90,000 — Major psychological support

- $83,800 — Strong Fibonacci + institutional demand

- $74,600 — Worst-case support if panic selling accelerates

Resistance zones

- $96,000 — First bullish checkpoint

- $111,000 — Broken trendline + cluster of past rejections

- $124,000 — Current all-time high

If Bitcoin prints a long lower wick, bullish engulfing candle, or RSI divergence, it would indicate buyer exhaustion and a powerful reversal ahead.

Bulls vs. Bears Which Side Will Take Control?

Bullish scenario (most probable for now)

Bitcoin stabilizes between $84K – $90K, reclaims the 20-day EMA, and rallies toward $96K, then $111K, before retesting $124K and attempting a six-figure breakout.

Fuel for this scenario:

- Supply scarcity

- Institutional accumulation

- Growing ETF inflows

- Macro liquidity improvement in early 2026

Bearish scenario (lower probability)

Bitcoin breaks below $83,800, leading to cascading liquidations and a spike in volatility. If fear takes over, BTC could retest $74,600 before forming a base.

However — even in this scenario, long-term structural bullishness is not destroyed. It would simply give long-term investors more time to accumulate before the next leg higher.

Why Billionaires Say This Is the “Last Chance Under $90K”

From a structural market viewpoint, this pullback combines four powerful ingredients:

- Oversold technicals

- Powerful historical demand zone

- Shrinking Bitcoin supply entering circulation

- Large players quietly accumulating during fear

Billionaire statements are not random — they are timing-based. They signal confidence that:

When Bitcoin leaves the $90K zone, it may never return to it again.

That doesn’t guarantee every dip is gone forever — but it implies that the macro average price of Bitcoin may shift permanently above $90,000 in the coming months.

Long-Term Forecast — The Road to Six Figures

If Bitcoin confirms a reversal, the price roadmap may look like this:

| Stage | Target Zone | Catalyst |

|---|---|---|

| Recovery | $96K | Reclaim of moving averages |

| Trend Confirmation | $111K | Breakout of bearish structure |

| All-Time-High Retest | $124K | Returning volume + demand |

| New Price Discovery | $135K – $172K | Institutional + retail mania |

The next parabolic run — when it comes — will likely be rapid, aggressive, and unforgiving to late buyers.

Bitcoin Hyper (HYPER) A New Satellite Riding the Bitcoin Momentum

While Bitcoin remains the king of decentralized security, its network is slow and expensive. That’s where Bitcoin Hyper (HYPER) comes in — a new project leveraging Solana-level speed while preserving Bitcoin-style decentralization and security.

Its goal:

- Lightning-fast smart contracts

- Ultra-cheap payments

- Solana-class speed + Bitcoin-class reliability

- Apps, NFTs, and meme tokens via a Bitcoin-powered ecosystem

The project has already passed its audit and crossed $28 million in presale funding, showing aggressive community traction.

HYPER is not a replacement for Bitcoin — it is the next logical extension, expanding what Bitcoin can do while Bitcoin continues to store global value.

If Bitcoin built the foundation, Bitcoin Hyper aims to build the superhighway above it.

Final Verdict — Is This Really the Last Chance Under $90K?

No price target is guaranteed, and no prediction is infallible in crypto. But the facts are clear:

- Bitcoin is in a rare historical accumulation zone

- Technical indicators support a reversal

- Market psychology aligns with late-correction fear

- Billionaire insiders are not betting on lower prices

For long-term believers in Bitcoin, this area marks one of the final “deep-value” windows before the next global wave of adoption and institutional demand.

Whether Bitcoin stays in this range for days or weeks, the message from experienced investors is simple:

Moments like this don’t come often — and once they’re gone, they’re gone forever.