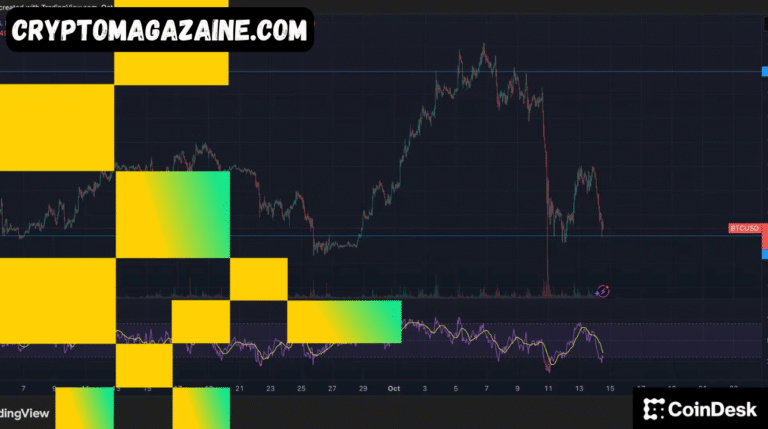

Bitcoin entered the final hours of U.S. trading on Friday under heavy selling pressure, slipping below the psychologically important $95,000 mark and cementing its worst weekly performance since March. The leading cryptocurrency has now fallen nearly 9% over the past week, its steepest decline in eight months, and is struggling to find support as market sentiment deteriorates across the digital asset landscape.

The downturn marks a dramatic shift from the earlier part of 2025, when bitcoin appeared poised to reclaim upward momentum after months of consolidation. Instead, BTC has slipped to its lowest price since May, rekindling investor concerns about stalled momentum, fading macro optimism, and the absence of meaningful catalysts in the near term.

A Painful Week for Crypto Majors

The weakness extended well beyond bitcoin.

Ethereum (ETH) dropped below $3,200, losing more than 11% since Monday. Solana (SOL) was hit even harder, tumbling 15% during the same period, reflecting a deeper pullback across layer-1 tokens that had previously outperformed in earlier bull cycles.

One exception was XRP, which managed to hold up comparatively well. With only a 1% decline, XRP’s stability may have been lifted by enthusiasm surrounding the debut of the first U.S.-listed XRP spot ETF, launched by Canary Capital. The listing generated a wave of attention and provided a rare bright spot in an otherwise shaky week for large-cap crypto assets.

Crypto Stocks See Mixed Results After Heavy Losses

Crypto-related equities also had an uneven week shaped by volatility and heavy sell-offs in the prior sessions.

- MicroStrategy (MSTR) — the largest publicly traded holder of bitcoin — fell another 4%, closing below $200 for the first time since October 2024.

- Key miners including CleanSpark (CLSK), MARA Holdings (MARA), and Hive Digital (HIVE) declined between 4% and 7%, highlighting the intense pressure facing mining stocks during periods of steep BTC corrections.

Despite the gloom, several companies managed to buck the trend:

- Hut 8 jumped 6%, buoyed by earnings from American Bitcoin, its high-profile joint venture with the Trump family.

- Robinhood (HOOD) and Riot Platforms (RIOT) rose roughly 3% each, showing early signs of buyer interest amid broader market weakness.

Investors Face ‘Information Vacuum’ as Government Shutdown Darkens Macro Visibility

Analysts across the industry pointed to an unusual but powerful source of uncertainty behind the recent market slump: an “information vacuum.”

This vacuum was shaped by what became the longest U.S. government shutdown in history, stretching from October 1 until Thursday. During this period, key government agencies were unable to release critical economic indicators, including inflation reports, employment data, and other figures that typically shape Federal Reserve policy expectations.

According to a report from Bitfinex analysts, this lack of data has left investors effectively “flying blind,” unsure whether inflation pressures continue to cool, whether job growth is accelerating or softening, and how aggressively the Fed may move on future policy decisions.

“The market retracement is the result of an information vacuum and political uncertainty,” analysts wrote.

“Key economic data is still missing to guide the market and the Federal Reserve, putting investors on standby.”

A temporary spending bill has now ended the shutdown, but it only funds government operations through January 30, meaning the underlying uncertainty has simply been delayed — not resolved. Investors remain wary that another political deadlock could emerge early next year, potentially renewing the data blackout and further dampening market visibility.

Macro Conditions Continue to Dominate Bitcoin’s Trajectory

Noelle Acheson, author of Crypto Is Macro Now, emphasized that bitcoin’s weakness is not solely technical or sentiment-driven. She argues the broader macroeconomic environment remains the dominant force shaping BTC behavior.

Bitcoin spent several months in a consolidation pattern, repeatedly testing — but failing to sustain — a breakout above $120,000. Without a clear macro catalyst, buyers lacked the conviction to push the asset higher, leaving it vulnerable to sharp retracements.

Acheson described the decline as a necessary market reset, a “flush” that needed to occur before bitcoin could attempt another major rally.

She also noted that while the next Federal Reserve rate cut may not come until the first quarter of 2026, liquidity injections, balance sheet adjustments, and other easing strategies could support risk assets sooner.

“Once this flush is complete, the longer-term case for BTC strengthens — but we’re not there yet,” she wrote.

Technical Breakdown Opens Path Toward $84,000 Analyst Warns

While macro uncertainty looms large, technical indicators offer an additional layer of caution.

Ledn’s Chief Investment Officer John Glover said bitcoin’s fall below the 23.6% Fibonacci retracement level — located just below $100,000 — signals the potential for a much deeper pullback.

According to Glover, the next major area of support lies near $84,000, a price level that aligns with multiple technical markers and historical demand zones.

He emphasized that bitcoin remains in the late stages of a broader bear-market structure, even if short-term bounces may occur along the way.

“We’ll likely see prices back above $100,000 before any sustained break below $90,000,” he said, suggesting that volatility will remain elevated for months.

“The full correction could play out through the summer of 2026.”

This outlook underscores a growing view among market technicians: the long-term bull case for bitcoin remains intact, but the short- to mid-term environment is defined by turbulence, not trend strength.

An Uncertain Road Ahead

Bitcoin’s slide below $95K represents more than a momentary setback. It is a convergence of macro confusion, political gridlock, technical breakdowns, and fading liquidity — conditions that have historically created challenging environments for crypto markets.

As investors wait for fresh economic data, stability in government operations, and clearer signals from the Federal Reserve, bitcoin may remain under pressure. Yet analysts agree on one point: once the current correction phase runs its course, the structural foundations supporting bitcoin — long-term adoption, institutional interest, and macro liquidity cycles — remain as important as ever.

For now, though, the road ahead appears rocky, with $84,000 emerging as a key level to watch if selling continues.

Read More: Asia Market Open Bitcoin Steady Stocks Mixed as Trump Signs Bill to Reopen US Government